Mayor Rob Ford showed up to his budget show-down presser yesterday wearing a Denver Bronco’s jersey, and I suppose the logic isn’t hard to fathom. The Broncos are considered the odds-on favorites to win next Sunday’s Superbowl.

Which means….

1. Ford is now a Bronco fan.

2. He’s got a “simple,” but so far undisclosed, budget plan to slash $50 million from the operating budget during this week’s council meeting.

3. Ergo (my word, not his) he will win at council, or something like that.

Of course, his plan won’t win. Ford hasn’t been on the winning side of anything in a dog’s age, and this week’s numbers fest won’t break that losing streak, even if there is an election set for the fall.

Indeed, one of the more perplexing ironies about Ford, a man obsessed with sports, is that he wouldn’t know a winning political tactic if Bronco QB Peyton Manning delivered it to him in person. What’s more, Ford’s play of choice is the intentional spike. He’s a kind of cartoon character who will catch the ball and then run it all the way into his own end zone so he can make a big point of losing.

But as with all attention-craving children, we’re going to spend many an hour tomorrow and Wednesday watching him repeat lies and assorted errant nonsense during the rhetorical pummeling that will follow the tabling of his motions.

A much more interesting sideshow will involve the fate of several confusing motions from the executive committee that boost the 2014 revenue projections from the municipal land transfer tax (MLTT) by $8 million, both to cover other spending and to mitigate a politically inconvenient 2014 property tax increase.

The MLTT – which now accounts for almost a tenth of the city’s net budget — continues to be something of a curiosity in the never-ending drama over the City’s finances. It was one of the two alternative revenue sources approved during Mayor David Miller’s second term. The tax exists because Miller and the provincial Liberals negotiated reforms meant to provide the City of Toronto with more financial latitude and authority over its own affairs.

Miller’s council was reluctant to take up the new taxing power the City had acquired. It took two tries before they finally settled on the MLTT and the vehicle registration tax. Ford, of course, successfully picked off the latter, and has vowed to rescind or reduce the former for much of his mayoralty.

The City’s realtors regularly get up on their hind legs and bray about how the MLTT is the worst thing that’s ever happened to Toronto homebuyers. They commission polls that apparently demonstrate widespread negative sentiment. But councillors don’t pay much attention, because in any given year, only a small proportion of their constituents find themselves in the home-buying category.

In any event, is there anyone in this city dumb enough to believe the real estate industry’s tales of woe? You know, the same group that feasts off obscene bidding wars, record-breaking development activity and so many sold-above-asking anecdotes that it’s impolite to discuss the windfall in mixed company?

Consequently, the MLTT has survived Ford’s, um, ministrations, and has gone on to become a bone fide cash cow for the City. Just consider this fun fact: while Ford brags about slashing $750 million from the budget (and therefore from public services) during his term, Miller, by getting the MLTT approved, delivered a total of $1.6 billion in incremental revenue to the City since its inception in 2008. To date.

Had the MLTT not existed, the Stintz/Ford plan to impose a property tax hike to raise $1 billion for the Scarborough subway could have never flown; the proceeds from additional taxes would have gone towards the City’s day-to-day needs.

Last week’s move by some on the executive committee to boost the projected income from the MLTT adds a new twist to this tale. Traditionally, when council hasn’t been able to balance the books going into the budget approval meeting, it dips into various reserve funds to find the missing pieces. Now, apparently, they’re looking to spend money that hasn’t come over the city’s transom yet.

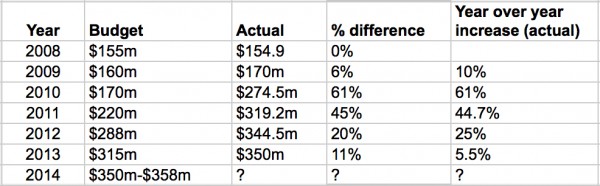

Ball in Ford’s court? Not so fast. As this chart shows, the City’s finance types have consistently low-balled — in some cases, quite dramatically – the expected take from the MLTT. The pattern, in fact, is very apparent: in the early days of the tax, City staff budgeted very cautiously, while the annual MLTT revenue grew at a blistering pace, especially in 2010 and 2011. (The chart, by the way, is bespoke – I had to ask for the historical breakdown.)

(Source: City of Toronto)

In the past two years, the year-over-year growth of the MLTT appears to have tapered, and the budget estimates have come closer to matching the actuals. This year, the initial 2014 projection came in at $335 million, which is actually less than the 2013 figure, although staff subsequently revised that number up, but urged council not to go past $350 million.

Has the MLTT crested? It’s possible. But the city’s real estate market, to which the MLTT is lashed, shows no signs of stalling. In fact, the Toronto Real Estate Board, the same outfit that annually bemoans the existence of the tax, predicted earlier this month that the price growth from last year seems likely to continue through 2014. So is an $8 million, or 2.2%, boost in the projected take unrealistically optimistic and cavalier? Not really.

The MLTT’s expansion, of course, is not limitless, and councillors should not get hooked on this type of budget-making, much in the same way that they shouldn’t depend on annual trips to the reserve funds to make the scales balance. But in a year when one lunatic does nothing but yell that the house is on fire, a slightly less diffident projection than usual won’t bring the roof tumbling down.

photo by George Kelly

9 comments

> the rhetorical pummeling that will follow the tabling of his motions.

Would it be possible for everyone at council to just ignore him? Like, after he tables his “$50 million” in “savings,” be all like “well, that’s interesting” and just move on to the next thing as though it didn’t happen? ‘Cause otherwise they’re just feeding the troll.

If TO Council can’t resist “Tinkering” with the Land Transfer Tax, just INDEX the Bands based on Average Sale Price.

Rate Bands haven’t moved despite surge in House prices since 2008.

https://twitter.com/mjrichardson_to/status/428165919764774912/photo/1

At least John Lorinc mentions the Vehicle Registration Tax as a useful revenue tool. But why don’t we get at least something from it again? It’s grossly unfair to have higher user fees for transit and all sorts of other usery (as it were) while a major drain on services (despite their costs and utility) get the freer rides.

If it would help to have firm destinations for the funds – like tree canopy and transit – then assign destinations and let’s do this! The problem is that the majority of the councillors are from the more suburban/car-driving areas, and the core is outvoted. And pays.

Ford’s recent trumpeting about cancelling TTC fare increases is just so ironic he did not seem to get it. He pointed out that the increase equalled VRT but saw both as some unfair burden on tax payers and not realizing that costs go up, revenue must too. His ‘logic’ is baffling.

In retrospect, it is too bad VRT revenue was not designated for transit (and/or road maintenance), so as to make it more palatable. It is interesting how many people registered vehicles outside city to save $, might partly explain large # of Ford supporters (by contribution to 2010 campaign) who supposedly live outside the city.

As always your logic is infallible. The MLTT must be working fine because those who don’t buy houses don’t pay it and those who do buy houses pay it as though they had no choice. Excellent work.

I also find Ford’s crowing over the TTC fare hike this year laughable because in the same year the VRT was cancelled, TTC fares went up. That fare hike brought in an additional $60 million to the City, about the same amount lost with the cancellation of said VRT. At the time the move was celebrated as a victory in “the War Against the Car”.

Dear Mr. Lorinc,

Please justify why a home buyer should pay $16,200 in Tax ($8,475 to Ontario & $7,725 to Toronto) for the purchase of a $600,000 home. What exactly does the City do with this money.

Please remember that the LTT needs to be paid in cash on closing and can not be borrowed or added to a mortgage. If you included the minimum 5% down a buyer will need in cash this means that a buyer will need a minimum of $46,200 in cash to buy a $600,000 home in Toronto.

I’m not saying the City does not need this money, but the money generated by the LTT is not ear-marked or allocated to anything. The revenue generated is added to the one big pot of money collected in tax.

It would be far move pro-active if the city said all the revenue generated would be used to fund a new subway/LRT.

The LTT is also a not a sustainable source of revenue as it’s based on a continual growth in the real estate market. What happens when and if the bubble bursts? How do you make up that $350 Million dollar hole in the budget if the real estate market cashes?

I believe you are also preaching to to choir Mr. Lorinc, otherwise you would be advocating the creation of the “Land Rental Tax”.

In fact why should we only limit the LTT to homeowners? Let’s use the same formula the LTT uses and apply it to people to who rent and create a “land rental tax”. We’ll take the annual rental of $1500 a month apartment… so $18,000 a year and apply our new LRT. Using the existing LTT formula that would be $90 to Ontario and $90 to Toronto every time you enter into a new lease agreement.

It’s only fair that people that rent in this city should also share in the burden of a land tax. I’m sure all your readers would back the creation of Land Rental Tax.

Hobbs,

It’s pretty simple: the provincial and federal government get revenue (GST and HST) from Toronto’s high land value while the City doesn’t. The city as a whole does not benefit in any real way from the sale of homes.

Ontario and Canada’s taxation system is so skewed that cities receive very little tax revenue when they are the ones that need it the most. The LTT is not perfect, and maybe should come down to a lower number, but this is the work-around that is needed for a city like Toronto.

Why not complain more about the province getting LTT revenue? They have it tagged onto a house too.

Joanne,

Residential homes are exempt from HST and Federal/Provincial Income tax (newly built homes are subject to GST, but the tax is buried in the price by the builder to reduce sticker shock and is subject to rebate). The Federal Government only collects Capital gains tax on the sell of 2nd home, like a cottage.

So, no, the Federal Government does not collect tax from homes and the Province collects via their own LTT.

I do think both the Province and the City charge way too much LTT for the purchase of a home. In Fact it’s 100 times more expensive then Alberta and the closest competitor is BC.

And it’s still unclear what the purpose of the land transfer tax is for.

To show you how punitive the LTT is in Toronto, here’s how a $600,000 home works in the rest of the country.

Toronto $16,200.00

Ontario (not in Toronto) $8,475.00

Saskatchewan $1,800.00

British Columbia $10,000.00

Alberta $160.00

Manitoba $9,720.00

Montreal $8,000.00

Quebec $7,500.00

Nova Scotia $9,000.00

PEI $6,000.00

New Brunswick $3,000.00