The federal election is upon us, and finally the cost of housing has bubbled up as the top issue. Vancouver area voters have waited with bated breath to see what sort of solutions would be on offer after a pandemic period where, despite job losses in the hundreds of thousands, weirdly, the cost of housing has increased by 30 percent.

Well, now we have answers from the major parties — worthy of gasps of disbelief. All three platforms fall back on tired bromides that can only make the out-of-control urban land price dumpster fire worse. Ideas so retro you’d think we were not only living pre-pandemic, but before the crash of 2008.

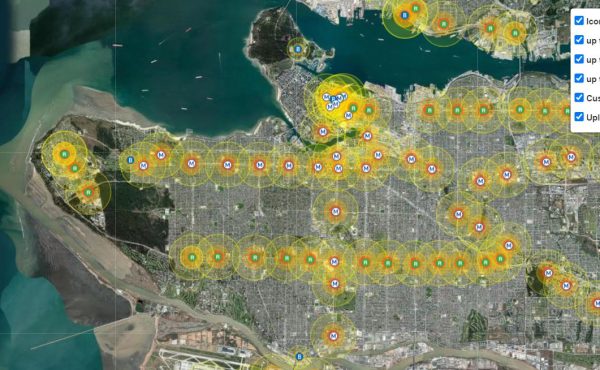

The Conservatives are probably the worst of the lot. Their plan calls for a national takeover of local zoning controls to ensure that higher density projects will get automatic approval near transit infrastructure.

Land speculators on your mark, get set, go!

New density near transit is good for many reasons but affordable housing is not one of them. Just look at the Metrotown district in Burnaby, where pricey towers replacing affordable flats have made Burnaby the demoviction capital of Canada.

Their plan might not be so bad if they insisted that some proportion, say 50 percent, of the federally steamrolled units, would be affordable to average wage earners. But of course, they don’t. Their plan rests on the assumption that if you add new housing supply — any supply — prices will go down.

Well, Vancouverites have heard this song before. We doubled the number of dwelling units in the downtown peninsula, boosting the population there from 40,000 to over 80,000 in just 20 years. Prices went up.

We added thousands of new units along our transit arterials. Prices went up.

We legalized over 10,000 secondary suites. Prices went up.

We made lane houses legal citywide. Prices went up.

The city changed so-called “single-family” zones citywide to allow a duplex, each with a rental unit with it, for a new density of four units on a 3,300 square-foot lot. That’s missing-middle townhouse density folks! Prices went up.

We did all of this over the course of just 20 years. And during that time prices for housing rose by over 300 per cent (in real terms). This doesn’t mean prices rose because we added so much density, only that it doesn’t seem to have lowered prices in the way that “supplyists” promised.

The Liberals are surely the second worst, offering a few small-bore demand-side changes (a two-year wait time for foreign ownership), some help for first-time homebuyers, some tweaks to the real estate transfer rules, and a continuation of their 2019 ”$73.4 billion housing plan.”

This last one sounds big enough to do some good until you look under the hood and see that the vast majority of the billions they claim credit for is actually treasury department loans for market-rate projects (again in the hope that just increasing supply will do some good).

Given that the Liberals run the show at the moment I will give them more space. Almost all of their funding goes not to actually guarantee affordable housing but rather to increase supply. They do this by providing, not grants, but loans to private developers.

They never say this out loud but it’s not really spending money if you want it back, with interest. The Parliamentary Budget Officer just last week put out an assessment on the efficacy of this spending in their Federal Program Spending on Housing Affordability in 2021 report, and the news was not good. It’s a long report and they are understandably circumspect, but a careful reading tells the tale.

Take this assessment for example: “Some programs with less strict affordability criteria that allow market-rate housing to be funded, like the Rental Construction Financing Initiative, may also be supporting private market activity that would have occurred anyway, or maybe crowding out private markets activity that would have otherwise occurred.”

In other words, the PBO is finding that government money is crowding out private capital that would have funded projects anyway. The feds are therefore claiming credit for building thousands of units that were already in the pipeline. So, if you are a believer in the power of new supply to fix the housing problem, this money is not even adding to supply.

It gets worse. This infusion of capital is probably actually driving up housing costs, as it is part of the glut of newly printed central bank funds flooding the economy with the intention of further driving down interest rates. Driving down real interest rates below the rate of inflation has the corrosive effect of driving up asset prices, housing in particular. It’s no big deal if stocks, gold, and bitcoin prices go up. That doesn’t do much harm to average wage earners. It’s a big problem when entry-level housing prices double in 10 years.

The NDP platform on housing is probably the least bad of the bunch. They at least suggest that they will directly fund housing that is affordable in more than just name, although they are disappointingly lacking in specifics on how this might be done. They headline the creation of a half-million “affordable” new homes, presumably subsidized. This seems a logical step since the same PBO report says that given current trends at least one in seven Canadians will need direct government housing support (either in the form of housing grants to renters or subsidized housing units). That’s five million Canadians. A half-million units is a good start but most needy households will be waiting a very long time for affordable housing under the NDP plan.

In the end, all three parties fail utterly to address the real problem, which of course is the out-of-control increase in home prices and rents.

None is willing to propose policies to drive housing prices down. Indeed, virtually all of their plans will do the opposite. Providing incentives for first-time homebuyers, low-interest loans to developers, and so on, all fuel out-of-control asset price inflation driven by the tsunami of central bank cash flooding the financial system. And the cancerous consequence of all this is the ballooning asset value of urban land.

All three parties propose to pour more gasoline into the out-of-control dumpster fire of urban land value inflation—inflation that has seen Vancouver area land values more than triple since 2010 while the values of the buildings on that land barely budged.

Under these circumstances, municipalities are very much on their own. No one from the federal government is going to save us. Cities and towns must use the only tool available to manage urban land price inflation: zoning.

We need to not simply zone for affordability, presuming that simply adding allowable new density will lead to affordability. It won’t. We tried that. It doesn’t work. We should not just zone for affordability, we should insist on it — by only allowing new density increases in return for guarantees of perpetually affordable housing pegged to average wages.

The housing market is completely broken. City land has been colonized by global capital. We need to grow a non-market housing sector to gradually decolonize urban land — extracting it from the insatiable appetite of the global market — and return it to the people who merely want to live and work here.

***

This piece was previously posted on The Tyee.

**

One comment

Yes, Vancouver has made a long list of changes. But have those changes produced enough units to meet demand? I don’t think so. Hence, the “supplyists” are right in many ways. These changes aren’t good enough, and the best way is to actually build housing in single-family neighbourhoods. Not duplexes. Not townhouses. Actual mid-rise density (although attention should be paid to quality). That would provoke developers to actually build housing, and over 60% of our urban lands would no longer be wasted.