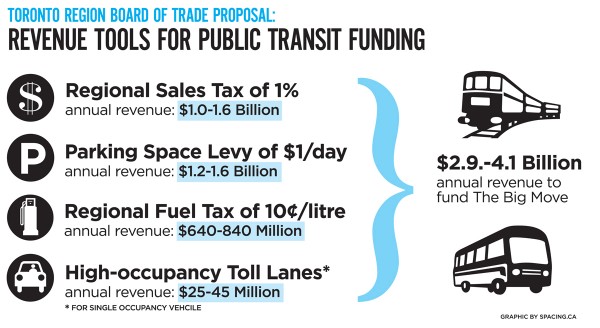

The Toronto Region Board of Trade has come out with a proposal which recommends a variety of ways to fund Metrolinx’s Big Move transit projects.

You can download the PDF — titled “A Green Light To Moving The Toronto Region: Paying For Public Transportation Expansion” — that provides a detailed analysis of their discussion paper.

What are your thoughts? Are these the appropriate revenue tools to use? Leave a comment below.

11 comments

The sales tax increase should be replaced by an income tax increase. The sales tax places to much burden on the poor.

The parking space levy should include residential parking spaces. Perhaps residents should be allowed to have one spot per household tax free and all additional ones taxed at the same rate as commercial.

Scrap the increase in gas tax (revenue loss would be more than made up for by the additional parking tax).

I suspect that the HOV toll would cost more than it would generate. Scrap it.

Fiscal solutions to the GTA’s transit woes shouldn’t always be an outside-in approach. I support, in principle, some of the suggestions on levying taxes on the larger sectors of economic activity that could benefit from better transit, but our existing models of service-delivery and cost-recovery are a bigger opportunity to keep transit fiscally-solvent.

The single-fare structure that the TTC- the largest operator in the GTA- has adopted, incents waste. A distance-based fare structure, similar to GO, helps recover some of the true costs of operating transit and incents better live-work choices, that will do more to reduce commute times and congestion than any new service or tax will.

Profit-sharing on value-capture around new transit infrastructure is also a lost opportunity, that could be a huge source of funding future expansions of service.

Simply taxing further, to fund bigger networks that run without any internal efficiency or rethinking of delivery models will only exacerbate the problem further.

Regional Sales Tax – What is to guarantee that my $ stays in Scarborough (Malvern) and doesn’t go to transit in Aurora?

Parking Sapce Levy – non-car users don’t pay this, discriminatory

Regional Fuel Tax – non-car users don’t pay this, discriminatory

HOV Toll – those single car occupants paid for the highway already

Why aren’t we talking about taxing cyclists? It’s always talking about charging car drivers?

Car drivers pay MORE to use their method of transportation than cyclists.

Regional Sales Tax – Make sure that it is directed to public transit, not roads. I can see some future politician doing so because of some “emergency”.

Parking Space Levy – Don’t have this passed onto the customers at a mall. End free parking and have it part of the parking fee.

Regional Fuel Tax – Forget it. Electric cars wouldn’t pay it, hybrid cars would pay only part of it.

HOV Toll – Hard to enforce. Forget it.

James Pitt is obviously a sock puppet for Doug Ford. But to counter some of his points:

• The sales tax would not stay in Scarborough ONLY, but a part of it would. The tax would be for the region and thus have to be spread over the region. Since Toronto has such a higher demand for transit it would get a much higher amount of this tax. That’s fair.

• The points about the parking levy & fuel tax being discriminatory is a false premise. Mr Pitt seems to think that a cyclist needs to pay his/her way for bike infrastructure then why wouldn’t be fair to ask drivers to pay the real costs of parking and fuel?

• Cyclists pay taxes. They pay it property taxes (either as owner or as renter) and they pay HST. In fact, the infrastructure drivers use is exponentially more subsidized than cyclists.

But this is all a distraction from the real issue at hand, which is how to pay for transit & reduce traffic congestion. Most of these methods are good, except for the HOV lane for single drivers. Just make HOV lane a toll.

The Toronto Board of Trade are, on the most part, business people. Don’t know if the Ford brothers are members because the recommendations don’t look like they had a part of it.

I was really surprised to read of this pointless proposal and have already tweeted my surprise and objections @TorontoRBOT and will be following up with letters to various people.

The last thing we need to do right now is to dilute the (limited) effectiveness of the HOV lanes we already have. This HOT proposal as designed will discourage HOV growth and cost a lot of money too … and the toll revenues are a fraction of what other revenue tools would bring in.

I think that this HOT proposal is not well thought out. Frankly it almost seems like it was designed not to work (30c/km on limited HOV lanes).

I personally think that if HOT is going to be considered we should first expand the HOV network by making all existing express lanes (on the 401, 403, 404, 427 and Gardiner) into HOV, adding HOV lanes to the 410, and converting the left 2 lanes of the 400 into HOV … and complementing those HOV lanes with expanded GO and municipal bus services.

With a complete HOV network in place then we can look at the HOT option. That HOT revenue can also be applied directly to municipal transit operating costs, part of the 25% of the Big Move we know so little about. So revenues collected on the 401 and 403 in Mississauga would go to MiWay, revenues collected on the 400, 401, 404, 427 and Gardiner and DVP in Toronto would go to the TTC, etc.

It almost scares me when I feel my “HOV then HOT” proposal is more “well thought out” than the one coming from the Toronto (and Region) Board of Trade.

Cheers, Moaz

@Tanzeel

I believe distance based fares will be implemented after Presto is deployed on the TTC. I suspect that it’s part of the reason Presto is so very far behind schedule.

“Profit-sharing on value-capture around new transit infrastructure is also a lost opportunity, that could be a huge source of funding future expansions of service.”

Not sure what you mean by this. Do you intend for the TTC / GO to develop property that surrounds new transit infrestructure? I like that idea, though AFAIK the city does not own enough land surrounding proposed stations to make any significant $$$ of partnered development. A missed opportunity, to be sure.

The TBOT transit tax revenue scheme will cost my family over $2000/yr on fuel and sales tax alone. What taxes are Corporations paying as their share of the transit burden? TBOT states businesses get of with NO tax increase while people should be held to that tax burden. That’s $2000/yr less my family can contribute to the economy via purchases. Multiply that by millions of people and that will hurt our sagging economy even further. Will our wages increase to keep pace with this new tax burden? I highly doubt that seeing the constant attack on wages from the Ontario Liberal & Conservative Government and also the Federal Conservative Government. They are freezing and even cutting wages so how can families afford to pay more taxes and keep the economy at a sustained pace? If Corporate tax cuts was the answer to the economic problems then the 6% Provincial Corporate Tax cuts in the last 5 years should’ve cured the economy yet it hasn’t so it’s time Corporations do their fair share and shoulder some of this tax burden. If PC Mike Harris, Tim Hudak, and Doug Ford Sr. Government hadn’t cancelled the Eglinton Subway in 1995 then the money allotted to the Eglinton LRT could have been used for a DRL. This transit mess is because of the Conservative government wanting toile their corporate friends rich on the backs of taxpayers. The 407 is a great example of that!! That’s why I agree with Andrea Horwath that Corporate tax loopholes pointed out by Don Drummond should be closed and that money used directly for transit before asking us taxpayers to pay more. Until then a huge number of people will oppose the TBOT transit funding plan.

I would be interested in more discussions about businesses investing in transit. If half your work force is stuck in traffic or on the TTC everyday the loss in revenue yearly due to gridlock should be some incentive to fix the problem.

Three proposals are enforcable. The HOV lane tolls cannot be administered with consistancy and should be scrapped. The present system cannot be efficiently administered. I would replace this revenue ctream with a 10 cent tax on each transit ride as this would directly benefit transit riders. 500 million rides per year equates to $50 million a year directly to the BIG MOVE. This can be easily administered.

The gas tax unfairly hits auto users. I would drop the amount to 5% and hit all drivers in the province.

Charging for parking where I shop is fair whether in a private lot or on the street. Charging for parking where I live and work is NOT. Street parking, city and private lots tolls can be taxed as transit users above. This is open, transparent and can be easily administered.

A sales tax increase for public transit is a very good idea. Perhaps a sliding scale such as .05% outside the GTA such as the Niagara Peninsula. An increase where the need is. How about .075% in the fringe areas such as Kitchener, Barrie and 1% in the GTA.

The proposals are there to be implimented and will be implimented. We have to decide how to make them as fair as possible. Cheers.