This past weekend, newspaper headlines were warning Toronto that 2010 would be the year that the city budget is cut to pieces. As the Globe reported, city staff have been asked to present to top city bureaucrats budgets that factor in a sustainable and permanent five per cent cut to their operating budget in 2010 and a further five per cent cut in 2011. In total, the city hopes to find almost $350 million in savings.

While the perception that waste is abundant at city hall permeates the body politic, if city council ends up approving a package of cuts that totals the reported $343 million, public services are going to be markedly reduced. As Jackson Proskow of Global Television reported via Twitter today, staff are using service levels from this past summer’s strike as a prospective operating model when forecasting scenarios for a -10 per cent scenario.

But the point of this post isn’t to talk about those cuts. There will be plenty of time for that next month when agencies, boards and commissions start to approve their operating budget submissions that get sent to decision-makers at city hall. This is just to contextualize a decision city council made this afternoon.

The decision: council narrowly voted to use a portion of the surplus of money accumulated as a result of the reduced service levels during the civic workers’ strike to offset the proposed two per cent garbage fee increase for 2010. The 22-19 vote was thanks to mushy middle councillors that Mayor David Miller used to have in his pocket (Raymond Cho, Gloria Lindsay Luby, Georgio Mammoliti and Frank Di Georgio) springing free to further their resume as political opportunists.

The strike surplus fund used to offset the fee hike is intended to be used to make up for the shortfall in the city’s 2010 operating budget. As has been widely reported, that fund accumulated more than $30 million in spite of garbage workers not going door-to-door since the temporary dump operations ended up costing the city more than it would for regular household pickup.

The $4.8 million it took to save each household about $5 (the increase that had been proposed for those with medium-sized bins) is a tiny amount in an operating budget that reaches upwards of $9 billion. However, I can’t foresee Lindsay Luby giving up her prized Etobicoke leaf collection service, nor Mammoliti paring down the Zoo budget when it might cost him a trip to have pointless conversations about Pandas in China, without a great fight. And that’s to say nothing of all the programs that mean the world to small pockets of constituents across the city and cost less than $5 million.

Don’t get me wrong, as far as tomorrow’s headlines are concerned, voting Yes to Karen Stintz’s motion is good politics. Even come next year when the Yes votes are all campaigning for re-election I bet telling constituents (just homeowners, actually) “I saved you from another Miller fee,†is going to win a few hearts. But winning this vote had nothing to do with improving the state of the city. As Shelley Carroll pointed out to members of council during debate, voting against this year’s fee hike puts the city on a similar course to what it was on when Mel Lastman began freezing property taxes in the Megacity’s infancy. The yeses in this case know as well as anyone how Lastman’s freezes turned out (Mammoliti has publicly admitted it was wrong of him to vote for them) and that whether it comes from cuts to services, a different fee hike or tax increase later, Torontonians will pay.

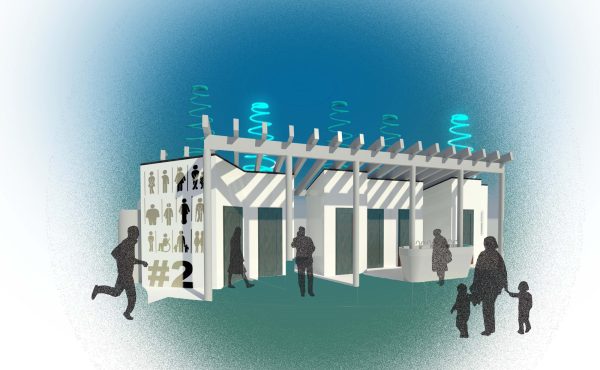

Photograph by wvs.

13 comments

Adam,

How many years has the city had to right the course that Mel’s tax freeze put the city on? What is the difference between increasing spending by 3% with a tax freeze or increasing spending by 6% with a 3% tax increase?

Since you seem interested in looking into bylaws of spurious value, any thoughts on this one…….

http://www.toronto.ca/legdocs/mmis/2009/bu/bgrd/backgroundfile-21113.pdf

It is possible to have an increase in service while using less tax dollars. Our health care system has proven that fact (they get better service in most of Europe, while spending far less money per capita than we do).

I know several people who worked in both the health care sector and Metro Hall and all of them have stated that the city is far more dysfunctional, wasteful, and inefficient. I can’t help but be skeptical when I hear try and persuade others that the municipal government is working at Pareto efficiency.

Glen,

I’m saying that now or later everyone (not just homeowners) is going to have to pay for this and that given the fiscal situation, it’s likely that we’re going to be paying in a worse way than a $5 per house waste charge. We might see it in property tax. We might see it in Parks & Rec fee increases. We might see it in service cuts. But one way or the other, that $4.8 million is going to have to be made up.

On your unrelated question, my understanding of that program is that it’s funded through the capital budget so when talking about the two expenditures we’re next exactly comparing apples to apples. But in any event, I think the idea of low-interest loans had merit and, when interest rates eventually increase again, it will again have merit. But at least this program is encouraging positive action and contributing to one of the top issues on Torontonians’ minds – climate change.

Shaun, I’m not seeing through rose coloured glasses here. There are certainly pockets of mismanagement and waste at city hall. It’s government. It’s big government. And it’s, in fact, so big that it’s inefficient (according to some research, twice as big, in terms of the population it serves, as it ought to be for peak efficiency). But anyone who tells you there’s $350 million in savings to be found without large service cuts is lying to you. Even contracting out services will cost money and, as we continually see with everything from street furniture to eHealth, contracting out comes with untold hidden costs.

Glenn,

The difference is over spending by 2.9% vs. overspending by 3%. Since the city has to make up the difference any way in the long run (not allowed to run a deficit, ever) and since spending has a positive effect on land values, over spending by 2.9% will be easier to correct over the next year, and by raising spending 6% the city has invested in every landowner’s property: making them all wealthier. Not to mention CVA means that the city might not even have to raise taxes.

So, yes, I support a 6% rise in spending along with a 3% tax increase–it’s less over the long run.

Richard.

http://www.thestar.com/comment/columnists/article/587633

“Gillette recommends a triage approach to budget-making.

He gives the example of a tough choice faced by Alexandria: a new plan to house homeless people with mental illness versus an existing program to help drug addicts.

The city, looking to cut $2.3 million (U.S.), couldn’t afford both and was at an impasse. Going through Gillette’s prioritizing process, the city decided it had an obligation to those already being served, so decided to delay the homeless plan.

Gillette says each city will have its own priorities, but argues it’s better to keep existing programs operating well than to trim them into irrelevance. It’s a waste of money, for instance, to cut a 12-week program to, say, four weeks in the name of cost-savings – in the process rendering the program ineffective.”

Let’s start cutting non-mandated programs in reverse order and leave our existing ones in place, then see where we are?

Adam – the problem with this is that the public doesn’t see capital tax and current tax, they see tax. There is also the issue that capital programs have current implications, i.e. more buses for TTC mean more bus drivers. The insulation program will be great for me as I’m actually doing work on my house right now but it is an unfunded program and there’s no direct benefit to the City of Toronto which will see them make that money back.

One of the nice things that would come out of carving off the TTC as a crown corporation would be that Denzil Minnan-Wong wouldn’t be able to yell that the City has hired “hundreds more staff” in 2008-9 when most of them were bus drivers to drive buses that would otherwise sit in garages.

Adam,

I don’t disagree with your point at all regarding the garbage fee. It is merely optics, a lateral move of money and a waste of time. Eventually the piper needs to be paid.

My point is that this is not an isolated incident. It happens all the time in Toronto. It could be argued that every time the reserve funds were raided it was in effect the same thing.

IMO, the program that I linked too is an even more egregious example. There are much more efficient uses of that money that would achieve a far greater result. That would entail a benefit to renters, which have little political capital. As such instead of the greater good we get the better optics.

Richard,

I am unclear as to what you are trying to say.

Mark, that most people aren’t policy wonks doesn’t make what I’ve said less right. And while you’re correct that capital impacting operating is a valid concern for some capital expenditures, this isn’t one of them. As far as your point goes about benefit to the city, I generally agree. I’m sure someone could pull numbers that say that if we don’t invest this $9 million we’ll pay more to deal with the impacts of climate change later. However, since we have to make choices, I think addressing the state of good repair backlog the city has going is a greater priority so the City doesn’t have to start ripping out dilapidated assets that have become safety hazards.

I’d like to find ways to get DMW to stop yelling fire too but the TTC already is its own corporate entity. The City just provides an operating subsidy. If it becomes a crown corporation, the only difference is that it’ll be Queen’s Park Tories doing the yelling along with DMW.

Glen, I’d say that in hindsight you’re right about raiding reserves. I say in hindsight because putting this off for 10 years and thinking that at some point during that time a provincial government would take responsibility for its own programs is not entirely unreasonable. Obviously that thought/hope did not become reality and we’re now, after six years of Mel and six years of Miller, at the worst case scenario.

I agree, savings shouldn’t come at the price of cutting services. Indeed, services should be increased with the province and the feds investing much more than they currently do.

Shaun: who do you think the “province and feds” are? There’s only one taxpayer, and that’s you. Provincial and federal money isn’t free.

Yes, but the taxes levied on the citizens of Toronto are often spend outside the city. Enormous amounts, in fact. This doesn’t happen in other parts of the world. There are cities in Europe that have far larger budgets than Toronto with smaller populations. It isn’t a matter of raising taxes, it’s a matter of distributing revenues differently.

Shaun, those taxes are also levied on citizens outside of Toronto. Those taxes also go towards health care, education, national defence, etc. You would have to provide evidence that Toronto residents are uniquely effected in order to have a point.