When council convenes this week to debate the new regime’s signature moves, I’m guessing Mayor Rob Ford won’t be rising to offer praise to former budget chief Shelley Carroll, former TTC chair Adam Giambrone and the senior bureaucrats who were allegedly complicit in the fiscal boondoggle that was the Miller era.

He should, of course, because this crowd — contrary to much of what we heard during the election — has made it possible for Toronto’s Waste Collector in Chief to deliver a property tax freeze for which he has no electoral mandate.

On top of the news from earlier this fall that the city will post a $275 million surplus for fiscal 2010, TTC chief general manager Gary Webster on Friday revealed that the combination of ridership growth and cost containment will yield a $60 million surplus for the same period [PDF]. The windfall, presumably, means the TTC will be asked to make do with a smaller subsidy from the city — $370 million compared to the $430 million that had been budgeted for 2010.

In other words, after the TTC’s annus horribilis, the embattled agency and Toronto commuters will ante up exactly enough cash to kill the vehicle registration tax for 2011. Because that’s how we’ll use the money in the post-war-on-the-car era, right? Certainly, the Fordists aren’t about to pat Webster on the head and urge him to re-invest those savings in better transit service or (shudder) lower fares.

The TTC windfall — achieved, it must be said, without the help of a professional board of citizen-appointees – brings the projected 2011 operating shortfall to a measly $168 million, down from initial estimates of $503 million.

Now let’s compare that opening position to previous years:

In 2009, the city entered the budget process facing a $679 million hole, which was subsequently filled with $400 million in one-time funds, including $238 million from Queen’s Park.

Coming out of the 2009 strike, the city was looking at a $500 million gap for 2010. But thanks to the strike dividend, lean wage hikes in the new collective agreement and some unexpected profits in the city’s investment portfolio, the Millerites delivered a balanced budget with a showily reduced tax hike, followed by the aforementioned surplus.

The savings came from a sweeping review by city manager Joe Pennachetti, who imposed across-the-board savings of 5% in each of 2010 and 2011. (Carroll, as budget chief, delivered the political support.)

It’s little wonder that Pennachetti, during last week’s executive committee session, repeatedly assured councillors that the city could balance its budget without a tax increase. After all, a $168 million gap isn’t such a formidable challenge when you’ve figured out how to surmount much larger fiscal chasms.

But instead of acknowledging the efforts of his predecessors and his own bureaucrats, Ford will yammer on about councilor expenses and the infamous snack table and leading by example, while his officials will take every opportunity to drive home the point that the new sheriff has delivered the long sought-after austerity we apparently crave.

If he’s such a straight shooter, let’s hear him give credit where credit’s due.

23 comments

Ahem…. It really is a stretch to call this a surplus. An excess in planned revenue, would be a more accurate term. If you want to judge their (Miller et al) performance, you have to simply look at the expenses. To do otherwise is to ignore the fact that billions have been drained from the reserves and changes to accounting methods, Cash vs. Accrual, skew the picture. By the same token the city could sell off all its assets and put the money towards the operating budget. This would not be a surplus, yet by your accounting here, John, it would be.

PS. regarding the TTC surplus, it should be noted that nearly half of it ($28 million) comes from lower fuel prices and lower depreciation expenses. It also benefited by having the majority of employment losses that occurred in 2010 located in the suburbs. Serving these areas is less cost effective.

Oh John, your articles make so much sense – filled with well thought-out arguments backed up with evidence. What a novel concept! It’s a shame that enlightened political commentary like this doesn’t fit into the absurd, sensationalized garbage that Ford used to win the election.

John, I heartly agree with the aurgument you are making, but need to quibble on one point. The surplus from one year does not reduce the operating deficit from the next year. It effects the balance sheet, and can be used to pay down debt or to invest against years with a short fall. But to treat such a surplus as income for the following year shows no fiscal prudence. It merely delays the day of reconning.

This is good perspective, but also in the comments, that a multi-million $ hole is still a problem, though lesser than it has been.

We aren’t necessarily out of harder times though – energy prices could give us more grief, and if there’s ever stabilization or decline in TO housing prices, that might be downwards revenues.

The one thing clearly missing from this is fulminating against the removal of the car registration tax; which is c. $64M, and could be used for such pinko causes as the property tax freeze, extra police officers as just promised by Mr. FFFord*, debt retirement, the road and infrastructure deficit, and oh, maybe some contract cancellation fees for underway transit projects?

The Cars Budget at City Hall isn’t a line item like the TTC; but some analyses show a substantial avoidance of costs/subsidies to these mobile furnaces, and we should not be ignoring the four-wheeled elephant in the living room and be keeping our revenue streams diverse.

Please think of prodding your new Councillors on this topic – Mr. FFFord does not necessarily have the votes, does he?

*Fine Fellow Ford

Many of the savings in last year’s budget are unlikely to repeat in the future. For example:

1) very little snow caused a big savings in snow clearing expense. This is unlikely to recur. Indeed, a higher-than-average snowfall is a reasonably foreseeable possibility that is currently unplanned. 2) Lower diesel fuel costs for the TTC. Very unlikely to recur. 3) The savings from the garbage strike. There really is no more savings left to squeeze out of the city without substantial reductions in service. Sure, one could cut the library budget by closing libraries and reducing the hours of those that remain. But is that the kind of City we want to live in?

I should add that draining the reserves reduces investment income as well as leaving the City without financial resources in case of an emergency. Which is what the reserves were put in place for – not to deliver tax cuts for people who are so rich that they can squander money on over-the-top luxuries like private automobiles.

Restructuring debt and delaying hiring are the only two things that occurred that Miller can take real credit for. The other stuff is good fortune and/or related to macro economic trends that, at best, the City aided in some small way.

Another thing to point out is that the TTC has to return its surplus to the City so when the TTC commits itself to asking for the same subsidy next year, it’s not with the knowledge that it has $60m sitting around. Though I suspect the TTC’s operating budget, as presented in January, will be helped by it being a bargaining year, meaning that TTC won’t show staff salary increases on its books for 2011 until that increase is negotiated/arbitrated later this year.

“let’s hear him give credit where credit’s due.”

Really, are you another one of those who thinks they can stop the world from spinning?

Get over it, we have another politician as Mayor for the next 4 years, that’s all. Don’t get bogged down in the micro finance of it all or you’ll miss the points really worth mentioning.

I would argue that there’s a significant financial management problem at City Hall. The difference between the initial and final budget shortfalls is too large, a result of politicizing the budgeting process. But worse, the difference between the final budget and the end-of-year reckoning is also way too large, telling us that our financial planners aren’t doing a very good job…

Harald,

It is my belief that our financial planners do, in fact, do a very good job. How were they to predict that last winter would have record low snowfalls? How were they to predict low diesel prices would give TTC fuel savings? How were they to predict better-than-forecast returns on the City’s investments? How were they to predict the savings due to the garbage strike?

Their Chrystal balls are no better than anyone else’s.

Re: *Fine Fellow Ford

Perhaps we should take a cue from Aldous Huxley and hereafter refer to the Mayor as “Our Ford” and recalibrate all Toronto calenders to turn 2010 into 0 AF (After Ford).

By 4 AF we should all be having a royal good time in the comments sections of this website.

Good analysis. But if credit should go where it’s due, it belongs with David Miller, the coach calling the plays that were well executed by the team.

Kevin Love’s comment… “How were they to predict the savings due to the garbage strike?”…

Easy… since the settlement reached was basically one that was attainable before the commencement of striking (ask those involved in bargaining for the union), the savings would have been a function of how many days exMayor Miller wanted the strike to run. I’m not the only one who sees the strike as both a deliberate (but miscalculated) cost-cutting move, as well as failed attempt to re-position Miller as a tough-on-labour mayor going into 3rd term.

I think that some (but not all) of the criticisms against the previous administration regarding expenditures are not justified given how the province has structured things. But I think the analysis in this article is wobbly…and dependent on such things as amortizing debt over longer periods and doing away with reserves, etc.

“He should, of course, because this crowd — contrary to much of what we heard during the election — has made it possible for Toronto’s Waste Collector in Chief to deliver a property tax freeze for which he has no electoral mandate.” — JL

You’re suggesting that a politician needs an “electoral mandate” to freeze property taxes.

Are you kidding? Every politician and civil servant has a duty to spend taxpayer money wisely. It’s obvious that if there is a surplus, then taxpayers have been overtaxed and any surplus should go back to the taxpayer.

City Manager Joe Pennachetti reported that he didn’t believe a tax increase would be necessary – and so, Mayor Ford responded appropriately by advocating the freezing of property taxes.

Why do you have a problem with that?

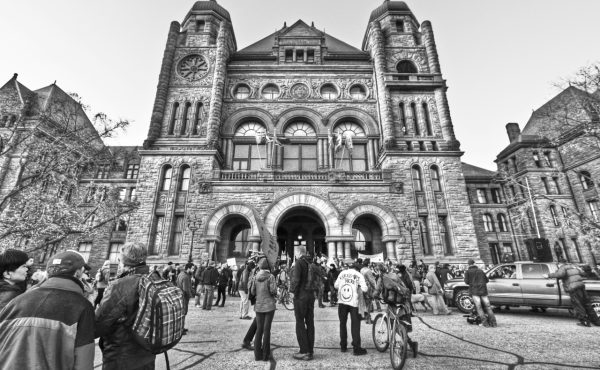

A great article, all this thoughtful discussion, plus a cool picture by DML! Spacing rocks!

Iskyscraper,

As modern, secular liberals, we must reject the religious conotations behind A.F. and B.F. and embrace the modern, secular version: B.F.E. (Before Ford Era) and C.F.E. (Common Ford Era).

@Helen — When Mel Lastman was elected as the first mayor of the amalgamated city, he promised property tax freezes. The result was that the city dug itself into a deep fiscal hole, and council is still trying to get out, over a decade after the fact. Many municipal expenditures grow due to inflation and factors outside council’s control, which partly accounts for year-over-year tax increases. By freezing taxes today, council creates a revenue gap in the future, which in turn affects service levels. That dynamic was very apparent by the end of Lastman’s tenure, which is why a property tax freezes remains a controversial promise, one that the voters of the city should have had the opportunity to consider.

@ John

You have often indicated that you believe the winning “mandate” in the last election was the Smitherman / Pants combo and Smitherman was on the record with a tax freeze so your concern seems to be about Mr Ford not the will of the people.

Let me reiterate – every politician and civil servant has a duty to spend taxpayer money wisely. For example:

In August 2010 City council approved (in principle) an $88 million hockey arena even though $34 million was what was earmarked – leaving a shortfall of “$29 million to $33 million.” Evidently they wanted to approach the provincial government for “funding options.” What does that mean?

To my knowledge, the City has trouble maintaining its other regular skating rinks and arenas without the support of a private sponsor – yet they are willing to add to the City’s (read that as taxpayer) financial obligations when the primary users will be the hockey players from middle class and upper income families. Can’t those people build their own private hockey rink? Haven’t we learned our lessons from the past?

In 2004 the SkyDome (price tag of $578 million including $360 million provincial taxpayer dollars) was sold off to private enterprise (Rogers) for a paltry $25 million. It was only fifteen years old.

Yet this summer we had City staff suggesting that even with a thirty-year City bond the $88 million four-pad waterfront ice rink would still be short by $33 million or so. It makes one wonder who will really benefit from the building of this four pad arena, doesn’t it? And if this is what they need the surplus for, then isn’t it wiser to keep a lid on taxes?

iSkyscapper,

I suggest that we go further up the Huxley family tree to Aldous’s grandfather, Thomas Henry Huxley and apply them to John’s contentions….

Irrationally held truths may be more harmful than reasoned errors.

those who refuse to go beyond fact rarely get as far as fact.

It is not to be forgotten that what we call rational grounds for our beliefs are often extremely irrational attempts to justify our instincts

Helen – I don’t know the full details of the stacked hockey rink, but I think your analysis is missing some considerations. For example, by reducing the footprint of the arena, the stacked design would allow additional developments and more investment value out of the neighboring land. Not to mention that a sprawling, suburban-style arena complex would be a pretty inappropriate use of waterfront lands. Personally I could care less about sports facilities, and I don’t know if this one is necessary, but it’s not just a matter of the city wanting luxury on a pauper’s budget.

The Skydome was never city property, and it wasn’t the city of Toronto that sold it, so I’m not sure why you’re bringing it into the discussion. Incidentally according to Wikipedia it was sold by the province for $151M in 1994 — it was sold to Rogers for $25M in 2004.

Now Rob Ford wants to get rid of this $60 million surplus by eliminating the $60 car registration tax which will save Toronto car owners $1.15 per WEEK (less than a Tim Hortons coffee). Eliminating this trivial car registration tax (a tiny fraction of the cost of owning a car) is a stupid, short-sighted political move and should be stopped.

A great article, all this thoughtful discussion.It’s a shame that enlightened political commentary like this doesn’t fit into the absurd, sensationalized garbage that Ford used to win the election.It is not to be forgotten that what we call rational grounds for our beliefs are often extremely irrational attempts to justify our instincts.