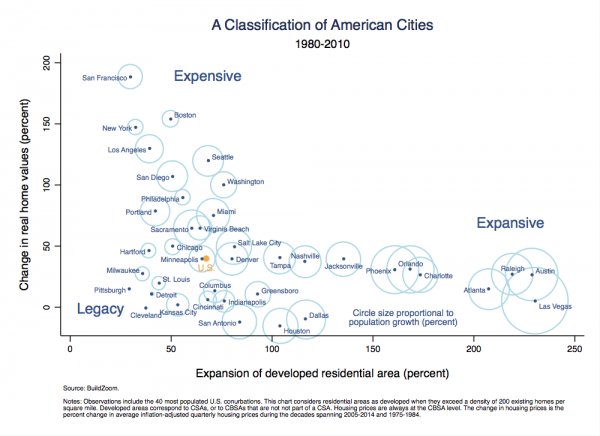

A recent study divided U.S. cities into “expensive” and “expansive” categories when it comes to housing. The high cost of housing in the expensive ones is, as usual, assigned to constrained supply — a failure to build more housing due to zoning restrictions and, in some cases, geographic constraints.

There’s a bit of a paradox, however. The expensive cities are almost all already among the most densely populated cities in the US (San Francisco, New York, Los Angeles, Boston, Washington DC, San Diego, Philadelphia, Miami) — although methods of measuring density vary widely. In other words, they already have the largest supply of housing in the nation for their size. San Francisco, often blamed for not allowing taller buildings to meet demand, in fact already has the tallest average building height of U.S. cities. And the study’s author admits that several of these “expensive” cities have also been, in fact, quite expansive, meaning they are also building housing out into their hinterland (“either four or five of the top ten largest expanders in the 2000s were expensive cities”).

Normally, a high level of supply would mean lower prices. And normally, if prices go up, demand should go down until it is balanced with supply. In the case of housing, that would mean people would move to expanding suburbs, which is, presumably, what happens in lower-density “expansive” metropolitan areas where prices are more evenly distributed; or, where there are geographical limits, they would move to different, more affordable cities, of which there are plenty in the U.S. But while that happens to some extent, rising prices don’t seem to be fully rebalancing demand in cities that are already densely populated. So if the U.S. cities that already have the largest existing housing supply are seeing demand continue and even increase despite high and rapidly rising prices, that suggests that something is going on with demand.

I wonder if there is a kind of “induced demand” effect for housing that helps explain this pattern. Induced demand (sometimes called “latent demand”) is a phrase normally used to explain why, when new highway capacity is built in urban areas, it soon becomes full and the level of congestion does not get reduced. It’s possible something comparable is happening in cities — the greater the supply of housing within a city, the larger the number of people who want to live there.

The underlying mechanisms would be different for housing than for highways. Induced demand on highways is generally explained in part by the fact they are usually a free good, so there’s no monetary price mechanism to balance supply and demand (instead, demand is regulated by time costs resulting from congestion). That’s obviously not the case for housing, where a price mechanism exists but doesn’t seem to be having the expected effect.

I would suggest the mechanism is more subtle, and integral to the nature of cities. Cities thrive because they bring diverse people together in a concentrated place, creating economic activity, innovation, and cultural creativity through mixing and mingling. The greater a city’s density, the more people are mixed together, and therefore the higher the potential for economic and cultural vitality. And the more jobs and interesting cultural activities there are, the more people want to come and live in the city, for both economic and lifestyle reasons. So the denser the city is, the more attractive it becomes. And the more people want to live there, the more willing they are to make sacrifices (i.e. pay more than usual for housing and/or live in less space) for the privilege.

Density could therefore become a self-reinforcing cycle, one that is partially immune to pricing. If a city’s housing market is subject to induced demand, the result would be that, just as increasing road supply doesn’t reduce congestion (because additional drivers are attracted to the new road and fill it until the time cost in congestion is the same as it was before), increasing housing supply in an in-demand city would not necessarily reduce prices. When new housing becomes available in this situation, enough additional people become interested in living in the city that the additional supply is filled up at the existing prices.

There are other factors too, such as transportation efficiency — if you live where jobs and culture are concentrated, you don’t have to spend as much time and/or money on transportation. So the greater the density where you live, the more likely it is that you will save money (and time) on transportation that can be spent on housing instead. But there’s a point where those savings no longer compensate for the high price of housing. As well, this factor is not very significant in cases of reverse commuting.

Another commuting issue might be that already-dense cities may have worse congestion, so that it takes a lot longer to get to work from outlying suburbs than in lower-density “expansive” cities, which creates a self-reinforcing cycle that increases the incentive to live in the already-dense part of the city.

There are potential limits to the vitality factor. If a city gets so expensive that only certain types of people can afford to live and work there, the concentrated diversity could get reduced (e.g. all the artists might move away), undermining the innovation and creativity that made the destination attractive in the first place. This danger can also be influenced by one dimension of induced demand, which is the element of wealthy people wanting to purchase second residences in an in-demand city. If they only live there part of the year, they only contribute to the city’s economy for part of the year. As well, they may be less engaged in the city’s civic and cultural life. This factor is thought by some to be affecting Vancouver; whether it is a significant factor in other cities is a matter for discussion.

Unlike induced demand in highways, induced demand in housing seems highly variable. In the mid to late 20th century, the high supply of housing in now-expensive areas such as San Francisco and New York’s borough of Manhattan did, as might be expected, mean there was a lot of affordable housing in those areas. There may be a natural cycle over time, or it could be that factors specific to that time period created the difference, or that factors specific to the current time are triggering the current induced demand.

Induced demand does not mean that dense cities should not build even more housing. There may be good reasons to build increased housing supply in cities where induced demand is in action. It simply means that improving the affordability of housing may not be one of those reasons (at least, not without government intervention).

An added factor is that, in an already-dense city, adding new housing will generally require building high-rise units on expensive land. Such construction involves considerable fixed costs, so that it is challenging for any new supply to be truly affordable (again, absent government intervention). As the study’s author says, “densification involves real challenges that render it more costly than expansion, so it would be less effective at curbing housing price growth.”

In theory, new construction could draw people out of older units, leaving those available as more affordable housing. But induced demand seems to mean that either new buildings attract new inhabitants to the city, or that any old buildings vacated are also in high demand. This effect is exacerbated by the way that, in recent decades, old buildings with “character” have become highly prized, undermining their traditional role of providing affordable housing (ugly old buildings might be the last resort of affordability).

Induced demand for housing may also at times be partially localized within a city, especially a large one — certain parts of the city might experience it even when others don’t.

(There may also be a reverse effect, where depopulation in a city triggers an accelerating collapse in demand even if prices go down).

Toronto, which has built more new high-rise housing since 2000 than any other North American city (and a fair amount of low-rise infill housing), is a useful case study in the effect and limits of induced demand for housing. The older part of Toronto has always had relatively dense housing, both low-rise and high-rise, and until the last decade of the last century a fair proportion of that was relatively affordable. Significant new mid- and high-rise construction (including some transformation of old factories to new, dense housing) began in the late 1990s as demand for urban living began to increase. As old areas brought in new inhabitants, and entirely new residential areas were created, demand for housing in these areas increased even more rapidly than the increasing supply. For over a decade, despite the steady new supply, prices of condos and houses went up rapidly as more and more people moved to newly vibrant parts of the old city. However, recently, condo prices have started to stabilize — at a high level — suggesting that the new building of condo units has finally begun to reach an equilibrium with the additional demand it encouraged (although it is still not reducing prices).

On the other hand, the price of Toronto low-rise houses is continuing to increase, because the ability to increase their supply is limited (there is little room for new houses in the city), and the demand for living in houses in the city continues to increase despite the prices. Low-rise housing thus seems to operate in a somewhat separate market from high-rise housing.

The lessons of Toronto seem to be that, when induced demand is in action:

- You have to build a lot of additional high-rise housing even to just stabilize prices.

- Even when stable, prices will still be high.

- Even a sufficient supply of new high-rise housing won’t stop the price of low-rise housing from continuing to go up.

If urban density has the potential to actually trigger demand, one solution to alleviating the pressure on dense, in-demand cities could be to encourage other, nearby cities to develop similar density benefits. A example might be Silicon Valley — an alternative or complement to building more density in San Francisco to house people who work in Silicon Valley could be to address the factors blocking the building of higher densities near where people work in the Valley itself. Not only would that mean shorter commuting times, but it could also aim to achieve sufficient density to trigger greater cultural vitality (transformations in the approach to urban planning might also be needed). Around Toronto, several Greater Toronto Area municipalities are seeking to create dense urban centres and transit hubs that could trigger urban appeal. The task of giving newly built cities the same appeal as established dense cities is not easy, however.

As well, as has been noted, it is challenging for newly built housing to be affordable, especially in already-dense cities where induced demand for housing has taken hold. Where there is not a sufficient supply of older, paid-off buildings in lower demand that can provide affordable housing, significant government intervention might be necessary to ensure that a portion of new housing in a location remains affordable, in order to ensure the diversity needed to keep a city vibrant. This government intevention could be direct, or it could also involve partnering with private and/or not-for-profit housing suppliers. Awareness of being in a state of induced demand for housing could help mobilize governments to take more conscious action to support affordable housing initiatives. And creating opportunities for expanding affordable housing could be a good reason to build additional housing in already-dense in-demand cities.

Induced demand for housing would just be one of several factors shaping the housing market in North American cities, but it may be an issue worth further investigation.

Graph from Issi Romem, “Has The Expansion of American Cities Slowed Down?“

The new Spring 2016 issue of Spacing is out on newsstands now. Check out our cover section on Toronto housing issues. You can also find a feature-length profile by senior editor John Lorinc on Canada’s largest urban archaeology dig happening right beside Toronto City Hall.

The new Spring 2016 issue of Spacing is out on newsstands now. Check out our cover section on Toronto housing issues. You can also find a feature-length profile by senior editor John Lorinc on Canada’s largest urban archaeology dig happening right beside Toronto City Hall.

Don’t miss an issue of Spacing by subscribing for four or eight issues.

7 comments

I’m a big fan of the theory “if you want affordable housing: build lots of high-end housing and wait.”

New construction is always more desirable than old construction, so rents are inherently higher. This is why Jane Jacobs expounded old-buildings as being essential to urban fabric: they are less costly to inhabit, because they are less desirable.

Buildings seem to have a 75-year shelf-life of depreciation in North America. After about 75 years, they reach their lowest possible value, and what remains starts to appreciate again because (1) the charm of an old building, and (2) if it’s still standing after 75 years, it’s well constructed and has inherent value for that reason.

The best way to alleviate housing pressure in Toronto is to build more units: lots and lots of more units. And start making neighbourhoods that are exclusive of new construction–for whatever reason–start paying for the privilege.

Agree with Dylan and Richard, we do need as much housing as the market is asking for. A stabilization in condo prices (although only in the 1 bedroom and 1+1 condos from what I’ve read), is necessary for a healthy city.

In line with that we need two more things in Toronto:

1) More rapid transit: New rapid transit creates a market for housing. The Sheppard Subway, Crosstown and St. Clair right of way have all generated new markets for housing and spreading the density across the city.

2) Rezoning of Existing Rapid Transit areas: Look along the University/Spadina lines and Bloor-Danforth lines and area around the majority of stations are low-rise residential. Take a look at Dupont, Eglinton West, Glencairn, Lawrence West, Yorkdale, Christie Pits, Ossington, Dufferin, Castle Frank, Broadview, Chester, Pape…. Within two minutes, you can from many stations into a two storey home, that is ridiculous. I’m not advocating for skycrapers, but surrounding these stations with 5-8 storey buildings would be a great improvement. We have spent billions of dollars (adjusted for inflation) on these subway lines and the residents of these areas are free riding on those investments. We need to rezone to take advantage of our existing transit and to help alleviate pressure on housing prices.

Richard, you are describing filtering. According to one (and perhaps, only) study, home depreciation bottoms out around 40-50 years. See City Observatory article: http://cityobservatory.org/what-filtering-can-and-cant-do/

Also, yes to more rapid transit and rezoning of existing transit areas!

“3.Even a sufficient supply of new high-rise housing won’t stop the price of low-rise housing from continuing to go up.”

Well, of course … because those low-rise houses can be bought by developers and replaced with high-rise housing.

In Toronto, you don’t really pay for the house, you pay for the land. A nice, big semi-detached house may sell for less than a run-down, small detached bungalow, because the latter represents a greater opportunity for redevelopment.

Peter, very low-rise homes are not bought and converted to high-rise housing. More typically, it is commercial buildings and parking lots, and offices buildings recently, that get the knockdown high rise treatment. The obvious reason is that the majority of homes are located in R zones where the only thing that can be approved is another house.

The last para is correct, that land value far outstrips building value, however, redevelopment potential of bungalows is limited to building a larger house on it.

“So the greater the density where you live, the more likely it is that you will save money (and time) on transportation that can be spent on housing instead. But there’s a point where those savings no longer compensate for the high price of housing.”

Money and time spend on transportation is lost, but money spent on buying a house you get back (and more!) when you sell. There may be a point, but the limit may be how big of a mortgage the bank will give you.

There is an argument to be made that housing construction induces demand. For example, if wages for migrants moving to a city are high enough to justify new construction, that means those people are likely going to be spending money on goods and services which will require businesses to hire additional workers.

With that said, I think the real culprit of higher prices in the most dense areas isn’t induced demand. It’s that the elasticity of the housing supply is not 1. As demand to live in a city grows, the housing supply is continually catching up to that demand. Since the housing supply doesn’t immediately meet the new demand, prices rise. As prices for existing land rise, the rents required to make a profit also rise. When growth slows, the end result is fewer units than needed and higher (but stable) rents. In other words, the way we grow our cities causes demographic sorting which is why a bid-rent curve exists.