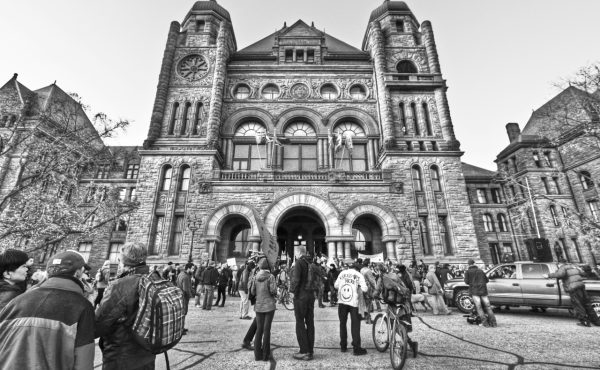

in The Toronto Star report today on the antagonism between real estate brokers and agents at a camp-out awaiting a pre-sales event at a Etobicoke condo development near Lakeshore and Parklawn.

This particular condo development has the ridiculous name of “Beyond the Seaâ€, though the only thing even resembling a “sea†would be Lake Ontario, on the other side of Humber Bay Park.

Real estate agents and brokers lined up overnight in a scene reminiscent of music fans lining up for hot concert tickets to go on sale (though the internet and Ticketmaster’s monopoly on event sales reduced this phenomenon). The reason? Quick profits. They all awaited to buy units to re-sell to the public with commissions.

Here’s one telling quote from the article: “‘We are going to take home $20,000 for 24 hours,’ said [Sofia Hassan, a real estate agent], referring to commissions. She started camping out at 9:30 Wednesday morning for yesterday’s opening.”

This is frustrating because of the hypocrisy of real estate agents that has contributed to Toronto’s fiscal crisis. Agents and brokers (like the ones lining up yesterday to make quick cash) crowded the Council Chambers on July 16 when the vote to adopt the land transfer tax was deferred. They predicted that the sky would fall if the city implemented its land transfer tax and lobbied hard to gather enough lightweights on council to vote with the right-wing. Meanwhile, tactics such as flipping yet-unbuilt condo units only helps to drive the prices up and prove that the market is overheated.

While Toronto condos are attractive because of good public services, transit, parks and proximity to jobs, these attributes are threatened by those who profit from these public goods.

photo by grantmac

23 comments

yeah and here’s me asking re another column in the G&M Real Estate Section this a.m. – Condo Corridor by Derek Raymaker: since building the Sheppard line was not justified by good planning (thanks Mel) and Toronto taxpayers are subsidizing the resultant development ($$$$$$$); who’s making out like money monkeys here (confidants of a previous mayor)? Or is this uninformed paranoia?

The paranoia will keep you sharp.

I bought a house recently, since then my respect for real estate agents went below that of lawyers and politicians.

Beyond the Sea? What kind of moronic name is that? I wouldn’t even consider it just because of such stupid name. Why not call it Beyond the Lake? Something like Faraway for the Sea would make more sense. Who comes up with these crappy names for condos? What kind of idiot is going to buy an apartment there and say “I live Beyond the Seaâ€Â?

I can’t wait to see the condo market collapse in these guys’ faces…

“‘We are going to take home $20,000 for 24 hours,’ said [Sofia Hassan, a real estate agent], referring to commissions.

Disgusting.

I smell a bust coming. If that tax cooled things down a bit it would’ve been a good thing.

…Toronto taxpayers are subsidizing the resultant development…

I’m curious how this is the case? Does Danial’s or whomever else has built up along Sheppard get some sort of break from the city?

And to top it off, we have to put up with their ads with their shit-eating grins every single day!

You have correctly identified some tacky agents and even tackier marketing ploys, but you oversimplify the land transfer tax issue. Agents have a good reason to lobby against the land transfer tax, particularly where first-time home buyers are concerned.

While not always pretty, the current condo boom combines high-density, pro-public transit housing with the possibility of ownership (compare this to rent-for-life New York and London).

The proposed vehicle tax is in keeping with goals to increase public transit, lower congestion and decrease pollution. The proposed land transfer tax does not fit as well with the city’s goals. It would be a stumbling block for those who earn modest incomes in creative or caring industries, immigrants, young families and singlesâ€â€the very groups that are likely to use public transit and add to urban life. (The tax wouldn’t “cool off†the market for those with higher incomes.)

We need a better mix of initiatives. If the land transfer tax is still on the table come Oct, first-time home buyers should be completely exempted.

The knee-jerk reaction to the gang of 23 seems to not consider the implications of the tax, including the negative effect it will certainly have on transit, just to name one issue that ought to have Spacing Wire readers glad to see it done away with.

As implied in Urmi’s comment. A $60 tax on cars has a relationship to increasing transit use: artificially raising the cost of housing in the central metropolis has the effect of driving people out to the suburbs, undoing what has been done.

But if the tax is not to be levied on first time buyers, what about seniors? Should old people selling off what may be their retirement funding be penalized $20-40k, then? It seemed to be the shiningi example of injustice when MVA was introduced that fixed income seniors in their own homes be stuck with tax bills hundreds of dollars higher than previously: why support something that would take tens of thousands from their retirement?

The first timer and senior exemptions have merit, but what constitutes a first-time buyer, or for that matter a senior? Couples are often parties to real estate deals; if one is 63 and the other 66, or if one has owned a house before and the other not, how will the decision be made? What about people transferring to Toronto? Or is it better to discourage corporations from building major offices here by introducing a substantial cost to the relocation of an employee? Will that improve city finances, having higher vacancy in the downtown towers?

Why levy it on the buyer, and not the seller, who is the one profiting? In which case will everyone be happy to forego tens of thousands of dollars from the estates of their parents? A transfer by inheritance is deemed a sale in the context of establishing things like capital gains tax – will the land transfer tax paid when purchasing be deductable from the capital gains registered for a property? Do you think that the federal government will forego tax revenue in this way? Or should we be paying tax on money that went to taxes?

McGuinty of course wants this tax levied because it deflects criticism from the main issue, which is provincial underfunding of the city (and not only Toronto). This thread shows how easily people are diverted from this issue. Mr McGuinty, support our transi…. what? Beyond the Sea? Bad!!!! Real estate agents make up bad names!!! Tax them! Tax them! er — what was I chanting?

The reason to oppose the tax – which is not a land transfer tax in any real sense since the taxing body doesn’t transfer any deeds of land – at least the city does run transit – is that it forces that small percentage of the population that buys a house in any given year to bear a disproportionate burden of the general burden of taxation, without their purchase or sale being related to the reasons for the shortfall. In fact, if the tax does flatten out housing prices, then that will in turn affect municipal taxes, which are, to the degree they are based on anything, based on property values. Lower property values, lower taxes, or a higher mill rate = higher rents, housing costs = more reasons to move to the burbs and buy that SUV.

your comments are completely out of context and totally oversimplified. You have taken the one comment of one idiotic person and generalized it to a whole group of people… 99.9% of whom have little or nothing to do with condos… The condo market is hot because many people not just realtors want to buy into it. 67% of the market are first time home buyers in Toronto and a condo is now a first time home buyers almost only option. The condo boom has nothing to do with the land transfer tax issue. If the mayor and his cronies can vote themselves a big pay increase a few weeks earlier then they can think of many other ways to raise taxes for the city. How about a visitor tax like most U.S. cities have for tourists. You pay $10.00 at almost every U.S. city everytime you visit. You comments demonstrate only the desire to sling mud at one particular group and no depth of understanding of the issues at stake.

….Toronto taxpayers are subsidizing the resultant development….

…..I’m curious how this is the case? Does Danial’s or whomever else has built up along Sheppard get some sort of break from the city?….

In 2002 Royson James thought the Sheppard Subway was the brightest idea since I don’t know what and he had no difficulty quoting Mitch Cohen on just how exciting a developer might feel about taxpayer funded public transit.

The Sheppard subway has played an absolutely huge role in the desirability of the area, says Mitch Cohen, head of the Daniels Group, builders of the point towers. Toronto Star November 16, 2002

“It is one of our least performing routes,” Giambrone said. Only about 40,000 commuters use the Sheppard line each workday, which is fewer than the number of passengers on the Dufferin bus route. CTV.ca July 17, 2007

Hey who could be against high-density, pro-public transit housing with the possibility of ownership? Nooobody. As a taxpayer I don’t have any difficulty with subsidizing public transit. Taxpayers all around the world subsidize public transit.

I do think billion dollar taxpayer investments in public transit should be well thought out and benefit the greatest number of riders possible. Taxpayers who subsidize profiteering by realtors or developers are being taken for a ride and it aint on a viable subway line. (Thanks again Mel.)

By the way on July 16, 2007, Royson James thought a “no†vote on the mayor’s proposed taxes was a good idea – would teach the mayor a lesson. Go figure.

Joan Guenther

Look, flippers do not raise prices. These agents are buying an underpriced commodity and selling it as a price people want to pay. They are not increasing prices.

If I bought a bag of onions for 10 cents, because someone had underpriced onions, and sold it for 99 cents, am I at fault for increasing the price of onions?

Flipping unbuilt condos is taking a risk on the future real estate market. As event in the US have shown, its very risky. But it isn’t contributing to an overheated real estate market — its a product of that markt.

Sean:

Thanks for making me a hypocrite. That’s so nice of you. Thanks for generalizing an entire profession. Thanks for your morals and support. It really makes me proud to live in this city with you.

Now, may I suggest a little fact checking. I read and re-read the Star article, and could not find an indication that the Brokers and Agents lined up are buying units for themselves to re-sell to the public. A $20,000 commission means a purchase of at least $1mil, and a serious downpayment. Reading Hassan’s comment, I doubt her craftiness. But hey, all the power to her if that’s the game played at Beyond the Sea.

I’ve sold over 100 new condos and acted as Buyers Agent on many other transactions. Builders allow Brokers and Agents to bring their clients to the sales centre to get first picks. Builders usually do not allow buyers to ‘flip’ i.e. sell the contracts before closing: it makes no economical sense to let someone make profits you could have easily made yourself.

Give me a call anytime and I’ll be happy to share my knowledge with you. Just please easy on the generalizations, they make for bad Karma.

All the best,

Omnivore asks “Should old people selling off what may be their retirement funding be penalized $20-40k, then?”

For a two-percent land-transfer tax to “penalize” a seller $20,000–$40,000, they’d have to be selling for $1,000,000–$2,000,000. They may have been “house rich and money poor” before they made the sale, which is a great argument against raising annual property taxes, but now that they’re “money rich”, guess what? The rich, occasionally, pay some tax. It’s not a human rights violation to make someone slightly less of a millionaire.

(If anyone’s curious, according to MLS.ca, 500–600 properties in Toronto are currently listed for over $1,000,000.)

If you want to penalise flippers, then put a surtax on property not retained for x no. of months. Don’t jack up land transfer tax for people who live in a property solely to catch flippers – that’s bad tax policy.

Eric Smith is entirely right – the high figure is unrealstic. This was my mistake. However, using simple searches to determine price is not realistic: In the High Park area west of Roncesvalles several properties listed below $1m have recently sold for over $1,2m, and many sell for within $100k of that magic number. If you’re going to use statistics, use ones based on sales, not asking prices. Based on this, the low figure is entirely reasonable.

I am not opposed to taxation, and I also don’t think that complex exemptions are a good idea. That was part of the point – I was responding to an earlier part of the thread where it was suggested that first timers (who are able to buy with a 5% downpayment, rather than a 25% one) should be exempt: in principle, but other groups also merit such consideration: I gave two examples.

Characterising seniors whose retirement is bound up with a house as money rich millionaires when the house is gone misses the point: $1m may have to stretch over twentyfive years of assisted care for two people: $20,000 per year, all in.Taxing away one person year is draconian, and probably counterproductive. The arguments for not taxing people who have no realistic way of being productive and no income is independent of the type of taxation.

Finally, to address Maulana Maududi’s point: while Adam Smith would be proud, the argument is wrong, first because agents aren’t buying and selling. And onions are more an example of the problems that arise if necessities of life (food, shelter) exceed the ability of significant numbers of people to purchase them. This is exactly why a free market never arises except in the fevered minds of economists. What we are seeing in Toronto is a real estate market corrosive to the ability of the city to maintain the communities that enrich the city but cannot afford the prices their contribution (in the arts, music for example) drive up.

A more relevant example would be a close relation of onions : tulip bulbs. http://en.wikipedia.org/wiki/Tulip_mania . Like many another overheated market, the question isn’t about market price but inherent value, and the role of irrational buying and selling.

Great discussion. I think it is important to clarify that I am not arguing that first-time home buyers should not contribute to the city, only suggesting that we need the right mix of measures to realize our vision for Toronto.

Moving away from this ‘vision’ measure and into the realm of “fairness” makes it a lot trickier (if not unworkable by the time vote-hungry politicians weigh in). If one takes the view that seniors who own lucrative properties are still vulnerable, the dramatic counterpoint can also be made: imagine being similarly vulnerable (immigrants unable to work due to restrictions, low income earners in artistic and caring professions, etc.) but without any assets to fall back on.

Every segment of Toronto will have to give a bit–but how we pay will shape the city we get. I am interested in your views on whether development levies on new construction match our growing transit needs (BTW, here, first-time buyers do contribute to the city, as developers recover these sums through purchase prices) and whether investments like the Sheppard line make the grade. I am also interested in views on road tolls and select user fees, for example on garbage pick-up (both curtail demand and raise revenue directly for services provided).

Sean:

I have called Sofia and she was telling me her words were taken out of context. I’ve posted the Sofia’s explanation on my site.

I’ve asked Sofia and she said assignments were allowed, with a max. of 2 units per buyer.

So my question to you and the other readers is, does it matter if a private buyer purchases 2 units or someone who is a licensed Realtor buys them?

If Realtors take advantage of a sale, it makes them hypocrites. But do their clients should be stamped as hypocrites if they send the agents to stand in line for them? to me, the essence of the sub-text here is “Realtors make too much money – too easily”.

I am currently promoting another buy-first-for-a-bit-less condo project in downtown Toronto [this is not an advertisement so I’ll keep the name off, and those who want to find out will]. We don’t do lineups, we use email to conduct business and we work on first-come fist-serve basis.

These type of investment are not for everyone, and it seems to be upsetting for those who do not understand the mechanics of an open market selling real-estate options, and yes, we believe that this project will be very profitable.

But then again, you could always “invest” in GICs.

All the best,

I appreciate all the replies on here, really. However I think it is worth it to read the entire post. The “hypocrisy” refers to the broker industry predicting dire results if a land transfer tax was approved, meanwhile making good money because of a hot real estate market – with Beyond the Sea proving how heated it can be. It is certainly no wonder why the city chose this tax as an effective tool to help address its huge deficit.

While Sofia Hassan did not come across well, the Star article certainly did not paint the agents and brokers in a glowing light.

Nevertheless, I think many people (including myself) learned something here. Thanks!

Aren’t there major tax breaks for homebuyers as it is? That is an unfair subsidy and only heats up the market more and encourages sprawl.

Its quite funny that one week developers are arguing against the land transfer tax, and then the following week complaining that the subway may shut down.

I suppose basic cause-and-effect eludes them.

Here here! In total agreement with the original post!

As for NY & London – the real estate problems there have to do with speculators as well, combined with huge numbers of super-wealthy people who have ‘vacation’ properties there, other market-distorters such as rent control (NY) and waaay too much subsidized/council housing (London).

As for the land-transfer tax, it doesn’t have that much impact on people buying a primary residence they plan to live in over the long haul. I don’t hear the same complaints about the absurd fees that go to the lawyers for what is basically a boiler-plate!

I can’t believe that anyone can argue with a straight face that the current condo market in Toronto is ‘underpriced’. As for this argument: “If I bought a bag of onions for 10 cents, because someone had underpriced onions, and sold it for 99 cents, am I at fault for increasing the price of onions?”

The answer is ‘yes’ if you a: colluded with all the other onion sellers not to sell below 99 cents (illegal) or b: issued press releases and ‘studies’ about the coming scarcity of onions and created a subsequent fear in people that if you didn’t buy onions today for 99 cents they could be five dollars next week, and insisting to anyone who’ll listen that prices ‘always’ rise.

Ila, have you even looked at statistics showing the past 50 years in property values/prices? You will see that prices most certianly ALWAYS go up over time and this is beyond inflation.

But my question is: How does buyer’s making profits from well priced real estate (and their Buyer agent making profits) infer any detriment to society?? Other than jealousy from those not doing so?

If the active real estate world wasn’t making good profits, they (5% of the population) would not be able to pay 50%+ of next year’s tax deficit for you so stop your complaining 😉 haha

Yes, actually I HAVE looked at the stats and historically real estate returns are pretty poor – averaging 1% above inflation over the past 200 years. Of course, if you have the sense to get out at a high and buy back in on a low you can do better, but timing the market isn’t something many people succeed in. Over the long haul, the best historic return is in small-cap stocks.

And there’s a lot of idiots in the US who were convinced RE prices never fall and are now walking away from upside-down mortgages. Just keep in mind that RE agents are sales people, not economists. They know shiat about macro economics, money supply, etc. See the ‘flippers in trouble’ blog which shows that in some areas prices have fallen 45% or more. They crashed in TO before too, you’re just evidently not old enough to remember.

Speculators ARE driving up real estate, particularly condos in Toronto something like 65-85 % of all activity in the last quarter or 2007 was done by ‘investors’.

The only reason I care though is because it’s the taxpayers who will have to bail these idiots out, as well as their equally idiotic lenders…