This regular online series will feature interviews with fascinating and influential urban thinkers, with a focus on discussing how Toronto can become a more engaged, accessible, sustainable city.

Hugh Mackenzie is a research fellow at the Canadian Centre for Policy Alternatives. A seasoned economist, he’s examined Toronto’s budget issues including an in-depth analysis conducted in 2010 on behalf of the Toronto Civic Employees Union. Spacing asked him to probe some controversies surrounding the 2011 city budget.

Spacing: What’s your opinion on Rob Ford’s decision to eliminate the Vehicle Registration tax?

Mackenzie: If you look outside Toronto to other municipalities around the world, what you’ll see is a broad debate about how to deal with congestion and how to encourage people to shift from private to public transportation options. That’s where a vehicle registration tax makes sense. However, Ford was right that the tax discriminated against suburbanites versus those living downtown, as there are probably a lot more people in the centre of the city surviving without a car. If you’re going to use the tax system to discourage car travel, it makes infinitely more sense to base a tax on use rather than ownership. That’s why levying tolls on expressways that funnel people into the city, such as the DVP and Gardiner, would have been the better option. It provides the additional advantage of raising revenue from those living outside the city who consume Toronto services but don’t contribute to Toronto’s tax base. A case could also be made for a peak-hour surcharge on parking in the downtown area. Ultimately, it all has to be done in an integrated way. If you don’t improve public transit but just levy charges, then all you’re doing is angering people. That was the major issue with the vehicle registration tax.

Spacing: Do you think the city’s public discourse has been hurt by too much negative hammering over taxes?

Mackenzie: I would broaden it beyond the city. Public discourse in North America has been fundamentally damaged over the last 25 – 30 years by debates regarding taxes and public services in which the link between the two is ignored. In Ontario, we’ve had a 20-year-long debate about levels of taxation without any reference to what the implications are for public services. When was the last time you heard a government say, “We need to improve a particular service by increasing taxes?” Regarding the municipal election, I believe anyone who says you can take $50 million or $2 billion out of the Toronto budget without cutting public services is lying to you. They either know that their promise is not true and they’re just saying it or maybe they don’t understand, in which case they shouldn’t be permitted to make such statements.

Spacing: Is the suggestion that Toronto “live within its means” realistic?

Mackenzie: I’m not exactly sure what that means because the government’s means consist of what citizens are prepared to pay for the services they’re provided. A city’s means aren’t fixed. A government’s means are determined politically, just as government expenses are determined politically. To say that the City should “live within its means” is to say nothing whatsoever. It only masks an argument for less services. When people make that suggestion, it’s undisclosed code for, “We know the cost of what we’re currently doing is going up and we’re not prepared to see taxes go up every year to pay for it. Therefore, every year we’re going to have to reduce the amount of services being provided.”

Spacing: Is the Ford’s decision to freeze property taxes for 2011 a wise move?

Mackenzie: I think it’s crazy. I bet that if you walked out on the street in Scarborough or wherever Ford got support, and asked people if it’s possible to cut property taxes without cutting services they would tell you that you’re crazy and it doesn’t work. People don’t expect to get something for nothing. Ford didn’t need to freeze property taxes. He was probably unaware during the campaign that the City’s finances were strong heading into 2011. Then he got his budget briefing from the City treasurer which showed a surplus of $200-250 million. Ford and his advisors knew exactly what they wanted to do with it. Ford is cut from the same ideological cloth as Jim Flaherty and Mike Harris. What they’re about is reducing the fiscal capacity of government. Anytime you freeze property taxes, that’s revenue that is lost to the City forever.

Spacing: Is eliminating extraneous expenses the best solution to Toronto’s chronic budgetary problems, as Ford suggests?

Mackenzie: No. Toronto has budgetary problems because the system of local finance in Ontario is designed to turn municipalities into supplicants to the Provincial government for money. The three major problems inherited from the Province are: one, the enormous deferred maintenance backlog in housing stock inherited after the housing system was downloaded in the late 90‘s; two, sharing the cost of welfare; and three, the elimination of capital and operating subsidies for public transit. Since 1996, the City has been struggling to achieve a balance between the fare box and property taxes as a source of revenue for the TTC. The City’s budget problems are not about council meals or whether the expense allowance is $50,000 or $30,000. This is about big-picture political decisions made at Queen’s Park. It doesn’t matter what Rob Ford does with incidental expenditures because it won’t alter the fact that every spring there will be a jousting match over the City’s budget.

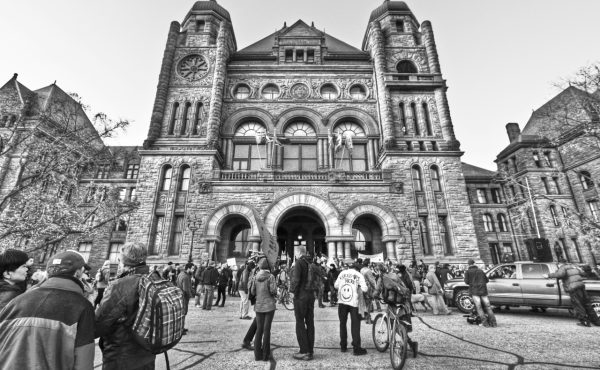

Photo by Steve Hoang

30 comments

Why can’t this man be mayor?

So, does this or does this not demonstrate that Mike Harris was about the worst (economic) thing that could have happened to Toronto?

And will Hudak will as bad?

We all know that a massive chunk of the City’s budget is employee salaries and benefits. We also know, most employees are in unions. The simply way of going about things is to form a “new” union with 15-20% lower pay scales and benefits for new employees to the City, Police, TTC, and all other associations. As existing employees retire, so does their escalated salaries and benefits. There’s the way to control expenses. It’s a take it or leave it scenario for new municipal employees. 15-20% reduction from current pay scales are still very competitive salaries with the private sector.

Wow, back in 2001 Hugh was saying that Toronto’s problems are a result of not being able to tax renters and businesses more. As such, it is hard to take him seriously. http://www.policyalternatives.ca/sites/default/files/uploads/publications/Ontario_Office_Pubs/oab_taxes.pdf

Let me see if Mr. Mackenzie is willing to tackle this question. On average, how much does each household in the city of Toronto consume in services? Now how much does the average household pay in taxes to fund that?

“If you’re going to use the tax system to discourage car travel, it makes infinitely more sense to base a tax on use rather than ownership.”

Precisely. Tax parking or tax vehicle entry into congested zones. It’s more effort than dinging people indiscriminately, but the people who suggested the VRT was “only $60” should look now at what such dismissal engendered in the voting public.

And the fact that you’re probably violating labour law is just the icing on the cake, right JT?

JT’s suggestion in know way violates labour law. It is no different in law than the Big Three damading and getting concessions from the CAW to preserve jobs. The perfect example is the garbage contracting issue. As has been described recently in the press, simply do not hire any new workers after retirements and as the CUPE numbers dwindle contract out the garbage routes one by one. Windsor just did it.

It should be remembered that Rob Ford did not finish university. I guess he missed or skipped the economics classes.

“A city’s means aren’t fixed. A government’s means are determined politically, just as government expenses are determined politically. To say that the City should “live within its means” is to say nothing whatsoever. It only masks an argument for less services.”

Perhaps Mr. Mackenzie might also consider the possibility that the majority of Toronto taxpayers – the ones who don’t work for governments – live with an economic reality that constrains their ability to pay for tax increases year after year after year. It’s also possible that a lot of Toronto voters decided there were some municipal services they didn’t need and couldn’t afford, in the same way that they have to make hard choices about their own family budgets. Dare I say it: Mr. Mackenzie should have more Respect for Taxpayers. (OK, unleash the torrent de merde now…)

Though I agree with the “tax based on use, not ownership” principle, it’s interesting to note that the majority of US cities with a vehicle registration tax not only tax based on ownership, but the amount of the tax is proportional to the year/make/model/mileage of the car. For instance, my 1992 Ford Taurus is $50 to register annually; my neighbour’s 2008 Nissan Altima was well over $500. In this sense, it’s actually counter-productive, as it provides less incentives to those with older model vehicles to upgrade to something more environmentally friendly. Perhaps it would be best to tax solely on mileage.

Paul, what JT is proposing is probably also now a violation of the constitution, because it would basically be ripping up existing contracts, which is a no-no. BC tried this once and this caused the Supreme Court to very helpfully rule, in a change to prior rulings, that collective bargaining is a constitutionally-protected right under the right to assemble. Not exactly the outcome the BC Liberals intended when they set out to change healthcare in BC. Talk about a back-fire.

We need more traffic. More traffic means more people coming into the core. It also means it takes them longer to leave, giving people an excuse to visit some of the nice eateries. The best tax on suburbanites – no parking on arteries during the morning & no fee for parking during afternoon rush.

My biggest saving this year is jeopardized by a tax freeze, because I decided to de-insure my car. (And not drive it, of course.) That’s saving me about $3000 this year, which, because I’m profligate and impulsive, has mostly gone straight to local restaurants and shops.

A tax hike combined with better transit and safe bicycle routes would make it easier for my friends to get rid of their cars, a move that could save them more than they pay each year in property tax. It feels a bit like getting a 100% tax cut.

It should be said that yes the debate on taxation is often incorrectly framed.

For instance, PMAN, municipal property tax is not a constant rate, it varies each year, automatically, to effectively reduce taxes when assessment growth occurs. What this means is, taxes (of this type) don’t rise w/inflation the way income tax or sales taxes do.

So its important to realize that tax freeze (municipally) is a tax cut. While a 2% tax hike, when inflation is 2% is a tax freeze.

Now that said PMAN and JT are not completely wrong, as someone whose very progressive and wants to see workers making a good wage….

I do object to TTC wages and Benefits having risen far faster than inflation, over the last 25 years. I don’t want anyone working for minimum (or close to it!) or not having access to medical/dental etc.

But the pension plans in particular have gotten a tad rich.

And that does have the effect of eating up precious resources, which is then offset by higher fares, lower service, or both.

There are a other similar issues, not just wage issues, but an abundance of small programs that you would not find broad public support for, which have driven up costs, and/or taken away resources from what some might think as better public priorities.

Take Toronto’s Cadillac snow-plowing service. That’s windrow service and residential sidewalks.

The old City, pre-amalgamation, didn’t spend on that. It therefore had money for lower recreation user fees.

I support a modest tax hike this year; and not equating eliminating free zoo passes with genuine fiscal discipline…

But I also do think its not unfair to tell some workers, the pension growth must end, retirement ages must rise (say by 2 years)

And also to ask the City to dump some services few need, and few elsewhere get, in favour of spending on civic priorities.

Then we can get lower user fees, and improve public services, without a drastic tax hike.

No One has mentioned the huge transfer of Toronto education taxes to elsewhere by the Province. (One guess who set up this unfair system.) Unless and until the province fixes the education tax to be fair to all Ontario residents, there will be a crisis in Toronto. If the City could move into the tax headroom that the province uses to subsidise the likes of Kingston and Windsor much of Toronto’s revenue problem would be permanently solved.

I think the whole problem with taxation is that it’s looked about backwards, you really need to look at it this way:

What services should the government provide?

What is the cost to provide those services, for the least amount of money?

Now add 10% for reserves.

Now feed that through the tax calculation to determine the tax rate.

It’s not about raising or lowering taxes, it’s about the cost of services, and if we have services that are expensive and not needed, get rid of them.

I wonder if Rob Ford would clean up Toronto’s taxi system, it’s a task that seems up his alley. Make it more fair for people to get a taxi license. Let Toronto’s cabs work the airport.

Kevin already nailed it. You simply can’t have ticket takers making over $100,000 without having those costs being passed on to the customer.

Nobody begrudges them making good money, but really….how much is enough?

JW: That’s not what Kevin said. And to assume that all those ticket collectors are making over $100,000 is dishonest at best.

The TTC puts workers in the ticket collection booth who are usually on some kind of injury-recovery program. They were a driver or mechanic or tunnel worker. They got hurt or fell ill and are working their way back into the job. That’s why a few might make that 6-figure wage. But almost all drivers make around $60k and of the 4000-plus drivers only 2 or 3 make that $100k salary.

Too-rich pensions, spending on expensive (read: useless) police services, paying for the fluctuation fuel, and paying down interest are the biggest concerns.

I would love to see how PMAN and JT would react to their corporate bosses coming in and telling them they are getting a big cut in wages. And see how much talent that company attracts when they offer jobs with 20% less pay. What these two commenters seem to miss is that private sector salaries for the jobs done in the public sector are pretty much on par. Its the benefits, pension and security that is different. I’m of the mind that governments are held to a higher standard and thus need to reward/attract employees.

This is not a defense of lazy, disinterested, and selfish City workers. Many exist in the city’s workforce, but no more so than the private sector. I think they should be dealt with in the appropriate manner and shouldn’t be shielded by union bosses more concerned with their position than with making the City work more efficiently. But too often the conversation about the city’s budget veers into the Weird territory and blame singular examples as the cause of the problem. Pre-Harris, there were lazy city workers. But we also had pretty ood gonvernment and services because it was funded well and it attracted top talent in leadership/management roles. I have no idea why anyone would want to work for the City considering the overheated rhetoric that is cast their way.

@Janine, which city in the US do you live in? I’m guessing it is of a very low income since anyone with any money has left, or is extemely wealthy with people who could care less about the tax. I find it unlikely it has the diverse income range of Toronto. Either way, US city policies are hardly a model to follow.

“That’s why levying tolls on expressways that funnel people into the city, such as the DVP and Gardiner, would have been the better option. It provides the additional advantage of raising revenue from those living outside the city who consume Toronto services but don’t contribute to Toronto’s tax base.”

So those who own businesses in Toronto don’t contribute to its tax base? So those who support businesses in Toronto by spending their money there don’t contribute to Toronto’s tax base? I do understand what you are trying to say, and I do agree with it, but that last statement really could have been worded much better.

And I agree with what Mark said earlier, saying that it’s “just $60” is simply ignorant. Ignoring the fact that $60 is on top of the provincial registration fee of $75, but $60 can take a hit on one’s disposable income. You can buy at least a few days worth of groceries, a new pair of shoes, or even 24 TTC tokens. Not everyone who owns a car is a multi-millionaire living in Rosedale, many are people just trying to get by and driving might be the best way for them to do so.

To add insult to injury, the money wasn’t even being used to improve driving in Toronto. Much of the road resurfacing was paid for with stimulus money – money Miller wanted to use exclusively for streetcars. Even if Transit City does get built, LRVs stopping every 400m is not going to be competitive to driving on the highway in all but the most gridlocked conditions. There were some bus improvements, but why not use some of that money to improve transit and some to improve roads? To tax drivers and then not only use that money to improve their infrastructure, but to dismantle it, is one of the reasons why Pantalone did so poorly in the election.

If the goal is to get people to take transit, why not make drivers pay $60, but they also get $60 worth of transit fare as well. This would encourage far more transit usage among drivers than to simply punish drivers for the sake of punishing them because driving is a sin among a small group of downtown elitists.

Wogster,

depending on who’s asking questions 1 and 2, the tax rate will be 10% or 150%.

With the 10% option, you’re looking at situations like that guy’s house burning down because he didn’t pay the firefighter levy.

With the 150% option, you’re looking at the City paying for a weather office when Environment Canada exists – oh wait, someone DID propose that…

“I would love to see how PMAN and JT would react to their corporate bosses coming in and telling them they are getting a big cut in wages.”

Actually, Petra, I just finished a 2-year contract that required me to commute to another city weekly while continuing to live in Toronto for family reasons. I’m looking for work at the moment, and I can only dream of the job security and benefits that our municipal workers have. Our family has had to trim its spending as a result of my job insecurity. Except of course our spending on property taxes, water/garbage rates, and nuisance fees like pet licenses and vehicle registration, which only ever increase. And by the way Petra, I’m not alone – most private sector employees in this town live with a great deal of wage and employment volatility. We’re also collectively maxed out on personal debt, which is now at an all-time high of over 140% of personal income nationally. Short of turning Canada into Cuba or North Korea, continual private-sector restructuring and cost cutting are going to continue to be our economic reality. So I don’t think it’s unreasonable to ask the City to take into account the ability of Toronto taxpayers to support municipal spending.

Considering Mr. Mackenzie’s work on behalf of Toronto Civic Employees Union, do you really think he offers an unbiased view? How about asking Don Drummond. Now that he has retired from TD he might be willing to offer his time. Few know more about Toronto’s finances than him.

Glen> When one accuses somebody of bias, you should point out where it is. If you don’t you sound all biased and stuff.

Shawn, it is listed in the bio; ” he’s examined Toronto’s budget issues including an in-depth analysis conducted in 2010 on behalf of the Toronto Civic Employees Union”. Do you really believe that Hugh will offer an unbiased view on the issue of productivity, wages and the size of the workforce?

I was to read an opinion piece on the sub-prime crisis from the chairman of Goldman Sachs, I would just as easily discount it as biased.

Shouldn’t you say why you think it’s biased? Judging simply by the source is easy but it’s sophistry.

Glen, I agree with Shawn Micallef.

It’s certainly OK to disagree with Hugh Mackenzie. However, it’s important to outline where the points of contention lie rather than just dismiss the viewpoint out of hand. If only just for the sake of having a healthy and robust debate.

No it is a matter of practicality not sophistry. I suggested that Hugh might be biased, pointing to the bio Spacing provided and of his previous work.

You seem to be taking my suggestion that Hugh might be biased as one that his remarks in the interview are incorrect. I did not say that. In large part I agree with them. It is what is missing that is important. Which is why I suggested that if Spacing was really interested in looking at the city’s budget, it should seek out someone whom does not benefit from being employed by the city workforce. Though since you require an example of his bias I would refer you to his report to local 416….

http://www.local416.org/files/file/CUPE%20report_Hugh%20Mackenzie_Reality%20check_Toronto%20s%20budget%20crunch%20in%20perspective.pdf

read pages 12-13. Hugh conveniently forget to mention that the reform was about updating assessments also. That there were million dollar homes in the city paying $400 per year in taxes because they has frozen assessments decades old. Hugh makes reference to the city only having access to 30% of its tax base, while ignoring that the reasons for that is that 30% underpays. He offers no consideration for those how live in multi residential apartments and even suggests that the shift in taxes away from them should be temporarily halted. Also look at his contention that Toronto’s municipal expenditures grew less than the Ontario average. Between 02-05 they grew slower, after that until 2010 they grew faster. Cheery picked numbers are what we expect from hired guns.

Hugh Mackenzie’s involvement with the Toronto Civic Employee’s Union doesn’t bother me for a few reasons.

1. He was chosen for an interview re the budget in order to help represent a particular point of view that I agree with as the interviewer and blogger. I don’t claim that it’s absolute truth only just that it’s one side of a particular argument.

Ultimately, the budget debate is a reflection of different views on how Toronto achieves financial sustainability. Ford and the right of council believe we have to bring services in line with revenue and keep taxes low. However, if we accept that approach then the consequence, as I see it, is a constant diminishing of services every year as delivery costs continue to rise.

I agree with Hugh Mackenzie that that is neither the best nor most humane approach to achieving sustainability. Whoever is in charge at City Hall has to somehow resolve Toronto’s financial incapacity vis a vis the province and/or find some creative way of generating consistent revenue.

2. Having conducted thorough research beforehand, I’m confident that Hugh Mackenzie’s conclusions are not distorted in any way but are the result of an honest and reasoned analysis. I feel that assertion is confirmed by very similar conclusions drawn by other studies including the KPMG audit of city finances from a few years ago.

Nonetheless, there is still plenty of room to disagree with Mr. Mackenzie and I encourage everyone do to so.