To tee up the surreal transit funding discussion that will take place at City Hall’s executive committee this week, here’s a quick recap on the witch’s brew of ideas/non-ideas in circulation right now:

Liberals: Mostly ignoring the expert advice she’s received from Metrolinx and Anne Golden’s Transit Investment Panel, Premier Kathleen Wynne continued to cave to Andrea Horwath’s demands last week by ruling out the HST and a gas tax hike as possible funding sources, and vaguely promising something in time for the budget.

NDP: Horwath’s crew now say they want to hike taxes for corporations and high-income earners, and claim these measures will raise about $1.8 billion per year, although it’s by no means clear whether all or some of this windfall will go to transit, and if the funds that are, in fact, pledged will be dedicated.

Progressive Conservatives: Tim Hudak says he’ll search diligently between the pillows of the provincial chesterfield to find the billions needed to build subways. But as many experts, including Golden and the Toronto Region Board of Trade, have said, finding efficiencies alone won’t pay the fare.

John Tory: After spending two years yodeling about the need for a revenue tool that spreads the pain as widely as possible – by which he meant the HST — and even lambasting both the Tories and the NDP for ducking the debate, Tory’s said nothing to date that suggests specificity.

Olivia Chow: Spokesperson Jamey Heath says Chow, who was the federal NDP’s transportation and infrastructure critic, has no position on any specific revenue tool, and told me I was asking “hypothetical questions.” “I don’t see why we’d get into debating which revenue tool is better when it’s not a council decision.” (Council, as it happens, spent a long and hallucinatory session last May debating which tools it should recommend to Metrolinx; it rejected almost all of them, including the property tax, which is now being used to fund the Scarborough subway.)

Karen Stintz: In defiance of the laws of gravity, economics and common sense, Stintz declared she would fund transit expansion without more revenue tools, pledging instead the proceeds of the 10% of Toronto Hydro the city’s allowed to sell.

David Soknacki: In an interview last night, he said he was “disappointed” by Wynne’s position and feels the whole suite of proposed taxes and levies should be on the table, including the HST, the gas tax, higher transit fares and even property taxes. “The more you put on, the less you need from any of those tools,” Soknacki said, adding that the Chow campaign’s refusal to take a position is “irresponsible.”

Rob Ford: He’s ruled out donations from Kevin Spacey to help underwrite the cost of new subways, so the fairy, um, dust option becomes that much more crucial.

So now on to this week’s absurdities: On Wednesday, executive committee will consider a staff “update” on Metrolinx’s investment strategy— or what’s left of it. The report, signed by the city’s three top bureaucrats, is a good one, as far as it goes.

They recommend more political representation on the Metrolinx board; additional latitude for municipalities in spending the promised 25% of dedicated revenues for local transportation initiatives; a return to the Bill Davis formula of splitting the net operating cost of transit service between the province and the city; and a distribution of funds based on the provincial gas tax formula, which was established in 2003 and relies on these principles (they are well worth quoting in their entirety, as itemized in the report):

- Allocation formula combining annual transit ridership and municipal population data, e.g. 70 percent transit ridership and 30percent population in the existing gas tax formula

- Eligible expenditures including growth and state of good repair, capital and operating

- Use of funds subject to general rules but not tied to specific projects

- Funds transferred irrespective of expenditure status, and unspent funds to be placed into a dedicated reserve fund administered by municipalities

- No municipal matching required and no restrictions on combining (stacking) with other sources of funding (e.g. Federal grants)

- Reasonable administration required on the part of municipalities in relation to reporting back on funding allocation to local transportation priorities.

All of this lands with a hollow thud, because no one has a fleshed out position on anything at the moment, and because the Wynne government, last Thursday, clotheslined (“pre-empted,” “short-circuited,” “rendered pointless…”) the council discussion by signaling its intention to nix the most economically viable and stable revenue sources. (A senior city official told me his team had no idea the premier would be making her statement when they released their report early last week.)

In effect, staff are asking council to push the province to take more specific positions on transit funding at precisely the moment when the Wynne Liberals are running as fast as they possibly can away from the revenue tools debate they themselves created.

“Caved in,” The Globe and Mail’s Adam Radwanski put it. A more nuanced accounting of the Liberals’ thinking can be found in Adrian Morrow’s report on Wynne’s speech: “One Liberal source said the government did not do a good enough job ‘managing’ the two expert groups to steer them away from politically unpopular recommendations.”

I ranted about this utterly depressing state of affairs on Twitter last week, but the basic architecture of the dynamic is well worth enunciating:

One, none of the three provincial parties have the guts to tell GTHA residents the hard truth about what’s required to confront the region’s transportation crisis, much less articulate the cost of inaction or the assuage the public about the relatively minor impact of new fees.

Two, the Liberals’ promised budget — which I’m guessing will contain a combination of borrowed funds for the downtown relief line and a vague promise to earmark future surpluses generated by economic growth — will be nothing but an election plank.

Three, the mayor — who is arguably to blame for much of the current policy chaos — has nothing constructive to say, which is not surprising. What is alarming, however, is that neither of the leading contenders for his job — Tory and Chow — appear to be willing to use the bully pulpit afforded them by an election campaign to stand up for the city and really hammer the provincial parties to do the right thing.

Here’s the rub: the next mayor will be expected to weigh in on this debate; after all, they’ll likely be sworn in shortly after the coming provincial election, just as the next government is making decisions about its spending and legislative goals. So if the top candidates don’t take a position during the race, how should voters judge whether they will be effective advocates for the city (and the region) once in office?

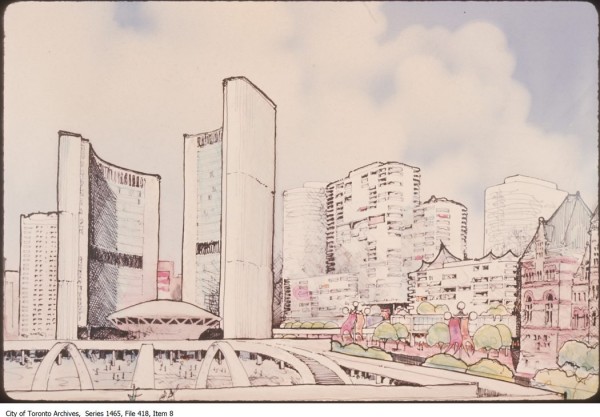

photo by City of Toronto Archives

21 comments

Unfortunately, the electorate is really to blame, because we refuse to understand that in order for real improvements to be made, new money has to be found. The message that somehow billions of $$ can magically appear from nowhere (or the overwhelming generosity of the private sector, for example) resonates more with Joe Public than “We’re going to need new taxes…” Until that changes, politicians from all across the spectrum will continue to contort themselves into pretzels to promise no new taxes (and to hell with the consequences to our future) in order to get elected. Some people may be coming to the realization that if we want more, we have to pay more, but not enough yet. That view is still in the minority.

“I don’t see why we’d get into debating which revenue tool is better when it’s not a council decision” – welcome to municipal and Toronto politics Jamey. I’m sure you’re a quick study.

While Wynne has formalised no pact with Horwath, it’s starting to look like Wynne is creating the conditions where she just doesn’t propose anything which might get Andrea vexed and start talking about elections.

I know that it is a common perception among pundits and many who comment on these boards that people are against taxes. But I think the real sticking point for most is not seeing value being generated for taxes that are being paid. Blame the electorate if you want, but the bottom line is that in order for a government to succeed in selling higher taxes (or revenue tools), that taxes need to be seen as: fair; that existing revenues (and infrastructure) are being used wisely; and that new revenues really will make a difference. Also, the government proposing the new taxes needs to be seen as acting with integrity. I think many people would argue that none of those conditions have really been met. The core issue is trust and whether governance is taking place in a manner that benefits the public good. I am one of those who believe that transit in the GTA needs to be more robust. Unfortunately, I don’t see the situation improving unless we have a coherent regional planning process in place AND the population targets (yes, immigration) is brought more in line with actual employment opportunities. Right now, you have a situation in the GTA where there is no real region-wide planning process (allowing developers to play municipalities off against each other so that development fees are only a fraction of what they should be. And you also have high population targets by the province and feds (which further add to congestion) even though the fact that half the jobs in the GTA are now “precarious” positions shows that the labour market is glutted.

I know it’s depressing from Toronto, GTA, GTHA position. However, as Christopher noted, it’s hard to sell taxes to an electorate who’s been lied to and believed it re the “evils of taxation.” I take some heart from the the fact that Ontario Liberals have actually introduced 3 new taxes in the past 10 years and sort of lived to tell that tale (Health Premium, HST, The NDP-requested tax increase on $500k plus earners). And the NDP have made it all that much harder by taking Hudak-lite populist position on transit revenue tools (taxes). Had Andrea Horwath come out strongly for these it would have made Kathleen Wynne’s job vastly easier. One hopes the recent Provincial turn is indeed an attempt to reach out to the NDP and come up with a deal that includes transit funding measures and another year of governing to implement them. As for Olivia Chow’s campaign, it’s excruciatingly challenging. She has to appear that she’s not a the dreaded “tax & spend” NDP, while balancing her coalition and leaving the door open to Horwath/Wynne. One also hopes the Chow campaign will move toward a clearer position as we get closer to the real campaign but one also understands the necessary (momentary) hesitancy.

I sadly have to agree with Christopher Brown. Not enough people are willing to even *try* to bear a meaningful tax measure dedicated for transit. However, the electorate does not exist in a vacuum; the provincial Liberals need to shoulder some of the blame here too. The public should rightly be wary of a new tax in the wake of the E-health / Ornge / Gas plant scandals.

*BUT* if each of the parties were more interested in governing for the good of Ontario, rather than just ensuring their best chance of getting elected, they would *all* be supporting a minor hike in the gas tax, as well as a small hike in the HST. It’s not just Toronto that needs investment into infrastructure; the whole province has needs.

Shame on the Tories, the NDP and the Liberals, in that order, for treating this important issue like a political hot potato. One of them should have the fortitude to take a risk in trying to convince people that this is an investment worth making. As for the Toronto mayoral challengers, only Soknacki has shown any willingness to embrace the methods of taxation that will get the Big Move going. The rest of them are too weak to take a position for fear of being attacked as irresponsible. Yet they each promise some form of painless taxation: don’t worry, the rich and corporations will pay. Don’t worry, the Province and Feds will pay. This blatant double talk is fiscally irresponsible, short-term thinking and weak leadership. Soknacki aside, the Others take them all.

@samg Re: the use of new taxes in a responsible way — the Liberals keep talking about a dedicated tax, but IMO, the way to really short-circuit the circular debate about accountability is for the government to pass legislation requiring the provincial auditor-general to do a thorough review of the dedicated transit revenues every three years, and make binding recommendations to Metrolinx. I have a lot of time for Metrolinx, but the political reality is distrust in government institutions. The AG as an institution generally has a lot of credibility with the public, so let the AG be the spending watchdog. That way, the fund doesn’t become a hot potato, and the cabinet/minister’s ability to meddle is curtailed.

Lee & Christopher – run for office on a program of tax increases. Please. I fully support a program of balanced taxes and fees dedicated to transit. But try to campaign on it. Really. People have to win elections or else they have no opportunity to enact laws. It’s simple. I find it disappointing that people want free-health care, cheap & extensive transit, etc. and don’t want to “pay” for it. But there it is. If the NDP had supported the original Metrolinx report we’d be off to the races but they didn’t. And the Federal government is nowhere. We are the only G7 country without regular national transportation investment. Something Olivia Chow has been calling for in Parliament. We have to hope that Wynne & Horwath come to an “understanding.” If not there will be a Provincial election and then who heck knows.

Excellent column on a depressing state of affairs. Ironic that today Paris is trapped under a blanket of smog and has made public transit free in an effort to reduce automobile usage.

As a mayoral candidate for Toronto in 2014, I implore the provincial government to take concrete steps to improve transit in the Greater Toronto Area as well as in municipalities across Ontario. It is absolutely crucial for the environmental health of present and future generations that we immediately take steps to reduce automobile usage. Of course by improving transit and providing safe cycling alternatives (dedicated bike lanes), we will also help ease gridlock which will in turn improve travel times for those who chose to drive.

I urge the provincial government to raise the gas tax and use a portion of the HST to fund transit. I am also in favour of higher taxes for corporations with a top end taxable income as well as extra taxes on high income earners. However these tools in themselves will not be enough to fully address the problem and thus I think that other measures need to be adopted.

Anyone who has traveled to Europe or even to Rochester knows that tolls can be an effective way of raising money. As tough as it is to be a car owner, and I do pity those who chose to drive or feel forced because of sprawl to own a car, the actual cost to municipalities of the automobile infrastructure is almost incalculable.

Toronto police responded to 51,000 collisions in 2012. 51,000! How much of the police budget is used servicing automobile transportation? The same question can be asked about EMS and about road repairs and maintenance. Homeowners, businesses and renters who may chose not to own a car are thus saddled with huge expenses that in turn impede positive city development in other areas like transit.

Also, as much of the vehicular traffic in Toronto consists of commuters from other jurisdictions, homeowners, businesses and renters are responsible for the cost of automobile infrastructure and collision investigation for those who commute into the city and do not pay for services. Looking at the problem in this way, tolls and/or parking levies for vehicles not registered in Toronto make a lot of sense and are perhaps an easier sell to Toronto drivers.

Unfortunately, politicians have dithered for 30 years and have been unwilling to make the hard choices necessary in order to bring public transportation in the GTA up to world standards. Transit improves GDP, accessibility and air quality. We must pull out all the stops now and make an investment in our future that will pay great dividends almost immediately.

I don’t think Toronto needs new taxes, it just needs access to the taxes it already pays.

Every fiscal year tens of billions of dollars raised through income tax leave Toronto to pay for infrastructure, hospitals, teachers, and other public expenditures outside of the City and the Province. If Toronto were its own province this would be clear in its massive contributions to equalization, but because its a city this reality is not at all clear. In fact its so unclear, and journalists are so terrible at properly framing this issue, that the Premier has to go out of her way to assure the people of North Bay that they won’t have to pay for GTA’s transit. Which is completely, totally ludicrous.

Toronto is funding nearly half of every public expenditure outside of Toronto, and voters have no idea. They actually need to be assured that the complete opposite isn’t happening.

How can we possibly expect voters to make informed choices when no one even understands the tax system?

There has never been a more important time for this conversation. With 3 elections in the next 2 years(Municipal, Provincial and Federal) its important to know where candidates stand. There is a great demand for what has been proposed(TransitCity/BigMove) and what needs to be added(Downtown Relief Line).

Once council decides a city-wide plan, the province and federal government must determine how much they will invest. Then, as a council, you decide what revenue tools to impose. We must keep Toronto affordable and encourage weekend visits, from our friends in the GTA.

As a candidate, my priority is:

-ensuring that those who come from OUTSIDE Toronto, during the week, contribute.

-I would also like to see :Tractor-trailers, dump trucks, delivery and moving trucks off our freeways(404/Gardiner Expressway) during weekday rush hours. There are plenty of them.

-Lets have an honest conversation about the debt. It costs more then the entire Fire Service budget, just to service. The $428 Million(est.) could be a dedicated form of funding to transit, rather then the bank.

-Lets listen to one another. None of us have all the answers. Its got to be a collective solution.

Ah, and there’s the rub. In general, the public doesn’t understand the tax system. There is no understanding about property taxes and how they work for municipalities, for example. There was a wonderful article on Spacing about this very thing a month or two back. There is no awareness of what the HST actually does and how it’s collected etc. Someone like Rob Ford can campaign on keeping taxes low in Toronto while user fees for services, TTC & recreation continue to escalate and people just don’t (or won’t) make the connection.

I understand that the perception of government waste is out there, and not without cause. But when we look at the bigger picture and see the multi-billions of $$ we as a province, we in the GTHA, and within Toronto need to invest in all sorts of things like transit, TCHC, water (as I’m writing this, I just watched a news story citing some $3 billion needed by TDSB for major school building repairs) and the list goes on; compared to that even what has been wasted amounts to an almost imperceptible drop in the bucket. That even $2 billion mis-invested of a $125+ billion annual provincial budget still amounts to 98-99% generally good money spent. We can argue the priorities of general budget spending another time. Unfortunately, I think that even without all the bungled $$s in the news lately, raising taxes, tolls etc is not something most people want to hear, period.

I should have added above that in addition to folks around the province not realizing that Toronto taxes contribute substantially around the province, people within Toronto don’t understand how they themselves are being taxed within their own city.

This is going to be a long one, here it is on my tumblr if you want to read it in a slightly nicer format: http://morganbaskinto.tumblr.com/post/79923104114/me-on-transit-funding

We need to be clear with the provincial and federal governments that the transit funding we have at this point is unacceptable. We have the lowest transit funding of any City our size. (I’ve quoted Andy Byford on that below.) We need a higher operating subsidy! The municipality of Toronto does not have the progressive funding tools to provide that. Nor do we have the tools to provide the $2.3 billion (over the next ten years) that are missing to fund the current TTC and add the sorely needed and provincially mandated full accessibility.

Funding real public transit requires real money. We need that money to get the city and economy moving. Considering the amount of money that leaves Toronto into both the provincial and the federal government, I am unwilling to fund it on the property tax. The property tax is needed to fund the basics we currently have as a city.

“We are, of course grateful for the contributions that the province and Ottawa already make with some capital projects and gas tax. But a successful Toronto enabled by a modernized TTC is good for Ontario and, ultimately, Canada. The city cannot continue to bear the burden of operating the TTC alone, and we cannot keep asking our customers to pay more and more. Something has to give.” -Andy Byford

I see two options. One, we get direct operating subsidies from higher levels of government and that with some other nickel and diming we do as a municipality will fund the TTC. Or two, the upper levels of government give us the progressive revenue tools to fund it ourselves. ie: access to sales or income tax or something to that effect.

Safety is soon going to be an issue. Despite steady fare increases, ridership has steadily gone up, something that was previously untrue. If we continue to grow ridership without service improvements or capacity increases it will become unsafe. We have all been on packed subway platforms, streetcars and buses. The more packed those situations get the more unsafe they become.

I want to be incredibly clear that we need to let transit professionals like Andy Byford do their job and give them the operating budgets to do them well. If we don’t, we cannot complain when the service is not up to par.

“According to Imperial College London, because TTC is one of only two subways outside of Asia and South America that covers its own operating costs, and due to its exceptionally high labour productivity and high level of service capacity and frequency throughout the day, ‘when compared with other metros in the world, Toronto’s Subway offers excellent value for money’. That’s an actual quote.

The TTC has the lowest operating subsidy of any major transit system in North America and, for that matter, any I can think of in Western Europe. At a mere 79 cents per rider, the TTC runs service 24 hours a day. Contrast that with Montreal ($1.16/rider), Chicago ($1.68/rider), Boston ($1.93/rider), and Los Angeles ($2.53/rider). Even the massive New York City transit needs $1.03/rider. If you need further convincing of the TTC’s efforts to be frugal, consider that in 2010, the TTC carried around 462 million rides for an operating subsidy of $430m. Four years later, we will carry 80 million more rides for a subsidy lower than that awarded in 2010. From a longer term perspective, over the past two decades, the TTC has seen a substantial improvement in labour productivity as evidenced by the fact that workforce has only increased by 18% while service levels have increased about 27% in order to carry an additional 32% in riders.”

– Andy Byford; http://www.cbc.ca/news/canada/toronto/ttc-boss-andy-byford-calls-for-city-hall-visionaries-1.2491775

I highly recommend reading this entire speech for any resident of this country. And I think it should be required reading for all politicians.

-Morgan Baskin, Mayoral Candidate

Excellent commentary John.

I having nothing to say until Wynne actually comes up with a credible funding plan that makes it clear last week’s kitchen table chat wasn’t a preemptive strike against Horwath in order to prevent a spring election.

Wynne says that she will bring in a dedicated transit fund as part of the budget. That was never in doubt…the big question has always been where the revenues that go into that fund will come from.

Last year I was saying that all existing transit funding should flow through the dedicated fund…which would help it to become substantial quickly without adding any new money. Then all “net new money” would be placed into the fund as well, helping it grow to greater levels.

I don’t know what will happen over the next 3 months but I’ll be interested to see if the Wynne government can survive on this ‘plan’ (of sorts).

Cheers, Moaz

Morgan Baskin said:

“According to Imperial College London, because TTC is one of only two subways outside of Asia and South America that covers its own operating costs, and due to its exceptionally high labour productivity and high level of service capacity and frequency throughout the day, ‘when compared with other metros in the world, Toronto’s Subway offers excellent value for money’. That’s an actual quote.

I’d love to see the source for that. Thing is, the TTC subway network covers its own costs but not all of the lines are self-supporting (Sheppard being the obvious lame-train).

Not to mention that the opening of the Toronto York Spadina Subway Extension in 2016 is going to put a dent in that ability for the network to self support….something that is going to make it harder to sustain the subway network (and by extension the rest of the system) without additional revenues.

Something for those subway-promising candidates to consider.

Cheers, Moaz

Paying for transit expansion in Toronto:

1. Small tax increases for corporations and the wealthy could fund transit expansion and operations. These groups had big tax cuts in the last 20 years while the rest have increasingly paid a greater share of taxes for things (like transit) we all use and need.

2. Low interest rates allow government to borrow for capital costs cheaply while unlocking potential for future development, creating jobs, and other opportunities for increased economic activity and therefore revenue for the public purse.

3. Make taxes or fees dedicated to build public trust in a time of skepticism of government (but also build smart stuff that is cost effective to build, serves the most number of people and is cheaper to run).

4. Use existing tax collection infrastructure to avoid diverting public money toward the creation of a system for collecting taxes (ex. We have this for collecting income tax, sales tax, gas tax but no existing system for special tolls, for example).

5. Commit to creation of job opportunities in connection with constructing more transit lines – in the case of Los Angeles support for a dedicated sales tax to build LRT was made in part because community groups made a link to the community benefits movement which has helped to pull people out of poverty and into good jobs and careers.

6. Ideally, taxes should be progressive, except when a less progressive tax serves an additional purpose, such as “pay as you throw” garbage, which has helped to increase recycling, or tobacco and alcohol taxes. To get people out of cars and onto transit we need better, more reliable and affordable transit. While increased fuel taxes, sales taxes, parking charges and development charges are regressive taxes, if they’re put into expanding transit capacity, they are worth discussing.

7. Show success to build support in the public. Repeat.

John

WRT to your response to samg; IMO the issue goes beyond accountability. The issue is in deciding what to spend the money on also. Transit has become a motherhood issue. Allowing for politicians to promote projects that reflect well on themselves but may very well be a poor choice in addressing congestion issues. Rob Fords Scarborough subway is an example of that. I would argue that much of the big move is that as well. It is based on employment and commuting projections that have proven to be entirely unrealistic. Under current conditions the chance of the Big Move achieve its goal of a 30% modal share of PT for work related commutes is laughable. If current policies remain in place the modal share will not only fail to reach its 30% target but decline from today’s 19.5% to 14.5%. So the question becomes should we be building something else instead?

The Impact of the Suburbanization of Employment on Transit Modal Share: A Toronto Region Case Study

http://docs.trb.org/prp/13-4261.pdf

The one thing I have learned in the past 4 years its that Toronto’s transit troubles have little to do with money. If we look at the money that is on the table now (Eglinton, B-D extension, SELRT, FWLRT) then there is actually enough money to build the following:

1. An Eglinton metro from Malvern to Mount Dennis, with elevated portions between Don Mills and Kennedy and near Centennial, and with underground portions as currently planned (Mount Dennis to Brentcliffe and at Don Mills and at Kennedy).

2. A Sheppard metro from Downsview to STC – both the east and west extensions. (Alternately, the DRL from Spadina to Throncliffe could have been built instead of the Sheppard line, but I suggest Sheppard because it serves closer to the areas that were proposed to be served by LRT).

People wanted to see rapid transit for long distance travel. Transit City was about moderate speed for local travel. Only after Transit City failed did anyone actually start talking about the DRL. Build the backbone of the system first (the Metros) and then fill in the rest with LRT or BRT as needed. This strategy would have been more acceptable by the people and would have been a better advertisement that their tax dollars would be spent on what they actually want.

PS. The fact that the current government has wasted so much money made it almost impossible to raise any taxes at this time. Maybe after 3 or 4 years, with a different government demonstrating prudent management of the economy, they could realistically ask for more.

@John Lorinc, I would agree with you that dedicated funding is essential. But in my view, that will not solve the problem in a situation where you have no strong regional planning body (and attempting to do transit planning with Metrolinx independent of overall land-use planning ACROSS municipalities in the GTA is to get this back asswards). The other problem is the rampant development taking place at a rate simply not justified by the actual job opportunities being created. The pace of this development, spurred in part by an essentially neo-liberalist immigration strategy (brought in by Mulroney pushed in large part by developers, banks and so-called immigration advocacy groups such as the Maytree Foundation (Hi Alejandra) which actually seem to have strong ties to the banking sector and seem to be pushing policies that continue to glut the labour market and contribute to the growing underclass across the GTA. I want to be very clear. I am not against immigration…. but before Mulroney, we had an immigration system that was tap on, tap off depending on the rate of job growth. That changed with Mulroney (in response to pressure from banks and developers citing demographic trends that have long since been discredited as well as others who saw the solution to economic woes in “growing” the home market) who set a permanent number of in excess of 250K a year (not counting refugees and foreign temporary workers). While all this might sound like a digression in a discussion on transit planning, I think it goes to the core of the problem. We seem to be on a development track that is way in excess of the actual job opportunities being created, thereby contributing to income inequality and straining infrastructure. Some folks are benefiting from this. Others are clearly not.

May I suggest that we really need the context of how cars are costing us? There’s an older figure from Vancouver of $2700 per car per year; disputed now by the CAA of course, and it will be a task to parse and define things. But that’s the real issue – we have car-avy in all sorts of budgets eg. the police, and transit is front and centre and an easier target.

Some details of other estimates left in the City Hall box for you JL as well as fussing about the big subsidy upcoming with the Gardiner rehab.

The good news is that there is strong public consensus that our city must build better public transit. It comes up at nearly every door I knock on. Smart transit expansion is likely the most important thing City Hall can do to improve Toronto’s quality of life, economy, social fabric, and environment. By “expansion” I mean both new construction but also – not to be overlooked – improving service and maintenance on existing routes.

The bad news is that the political debate about transit feels broken. It is broken in part because it too often separates the question of what we must build from the question of how we will pay for it. Promises of large infrastructure projects without a financing plan are misleading. So are unfunded commitments to expand service. After decades of transit plans and only halting progress, these kinds of promises no longer pass the public smell test.

Building the transit we need will cost money. If we want to build a public transportation system that suits a city of Toronto’s size and potential, then many of the people who live here and businesses that operate here are going to have to chip in. The question is how – and for what.

If elected officials are committed to public transit, I believe it is their responsibility to help create the conditions in which the public is able to say “yes” to a financing plan. Some of those conditions include:

• Spend the transit money we do have wisely – this is why wasteful decisions like replacing the fully-funded Scarborough LRT with a much more expensive subway are so harmful; they erode public willingness to entrust City Hall with transit decisions. If we are going to ask the public to chip in for transit (as we are asking them to do with the Scarborough subway property tax hike), we should do so for projects that have strong public support and are backed by evidence.

• Do not rely solely on “cap in hand” as a funding strategy – yes, Queen’s Park and (especially) Ottawa should be part of the transit financing solution, but relying solely on the munificence of a fiscally strained provincial government and a federal government that is unlikely to embrace a strong cities agenda is not a credible approach. Particularly not from a city that has been pursuing a deliberate policy of “tax cuts first” over the past four years.

• Keep funding options on the table – Too much political debate over public transit – at both the city and provincial levels – has been about taking funding options off the table. These moves may reassure “squeezed” residents (who are also “squeezed” – for time, money, productivity, and quality of life – by inadequate transit service) in the short term, but it fails us in the long term.

• Link funding to specific investments – The public seems more likely to support new transit funding if they know where it is going; in the words of the Golden panel, “dedicate it or forget it.” At this point in the debate, it is hard to tell what specific investments new revenue sources would fund. And given the hardly evidenced-based track-record of transit spending decisions over the past few years, it seems highly unlikely the public will be willing to issue a blank cheque.

• Think progressive – Tax policy can be very targeted, finding ways to protect the vulnerable and those living on a fixed income. Any tax and fee changes to fund transit should be progressive: they should help combat inequality in our city, not make it worse.

The next City Council has an opportunity to play a leadership role in creating these conditions. Why not build on the extensive work on transit planning and revenue tools that groups like Metrolinx, the Toronto Board of Trade, and the Golden panel have already done, instead of shutting this work down? Why not find creative ways to engage the public in an honest, fact-based, and deliberative way? What if Councillors partnered with city staff, community groups, and even MPPs and MPs, to organize community workshops on the revenue options and the kinds of transit improvement those options might buy? Why not consider even more in-depth public engagement mechanisms like a public referendum?

In short, better transit will require new revenue. And finding new revenue will require more responsible, honest, and informative political debate.

Thanks for the opportunity to comment on this crucial issue!

Alex Mazer

Candidate for City Council (Ward 18 Davenport)

http://www.alexmazer.ca