The City of Mississauga, hailed by critics of the City of Toronto as a financially sustainable paradise for many years, is now anything but.

It’s been forecasted that by 2012, Mississauga’s reserve funds, enriched by decades of sky high development charges, will run dry. The years of sacrificing farm land for the sprawling subdivisions that bring in those charges are coming to an end as the last of the greenfield development opportunities are snapped up.

Suddenly, as Mississauga reaches the age at which its major infrastructure requires repair and replacement for the first time, Mayor Hazel McCallion is finding herself in the same position as mayors of older Canadian cities. Now, Hurricane Hazel will have to decide whether to finance her city’s infrastructure renewal through dramatic tax hikes, selling off assets, relying on debentures or lobbying the provincial and federal governments for more money to finance her city’s infrastructure renewal.

To this point Mayor McCallion has chosen to increase property taxes by 3.9%, apply an additional 5% property tax increase in the form of an infrastructure levy, engage in public fights with the federal government and quietly negotiate with the provincial government. But, if a decision made yesterday is any indication, that still isn’t enough to sustain the city over the long haul.

The City of Mississauga’s plight became abundantly clear yesterday when city councillors elected to move toward selling off its 90% share of the hydro utility Enersource. According to the Toronto Star, the corporation is valued at approximately $250-300 million (though it also has a debt of $289 million, which could impact its sale price) and Mississauga budget documents show that the City receives an annual dividend of $8 million [PDF], which equates to approximately 3.2% of the City’s non-property tax revenue stream.

By selling off the utility to a private company, the City of Mississauga may get about 30-35 years worth of dividends at once but it will lose out on future profits and have to compromise a great deal on local infrastructure issues. Additionally, with the sale of the utility goes the City’s ability to influence what happens with hydro polls, transformers and wires that can require intrusive construction projects (such as digging up roads) as part of maintenance.

Clearly selling off an asset as lucrative as a utility company is a sign of desperation.

But Toronto, which has been living hand to mouth for the past decade, may find itself in this same debate sooner than later. The blue ribbon Fiscal Review Panel that reported [PDF] to Mayor David Miller in February has recommended selling off some or all of Toronto Hydro, valued at $2.6 billion, to pay down the City’s debt.

The Rami Report

Many a community crusader can claim to have had their finger prints on a City report but few can say they, literally, have their name all over one. Illegalsigns.ca founder Rami Tabello is one of those few.

The civic bureaucracy doesn’t tend to acknowledge the work of local activists by associating their name with the action they influenced. Yet Tabello has his name published four times in the report scheduled to go before the Licensing and Standards Committee tomorrow, while Illegalsigns.ca is also mentioned in four separate locations.

More importantly, the report indicates that the City has or will be taking action on a long list of signs Illegalsigns.ca has filed complaints against.

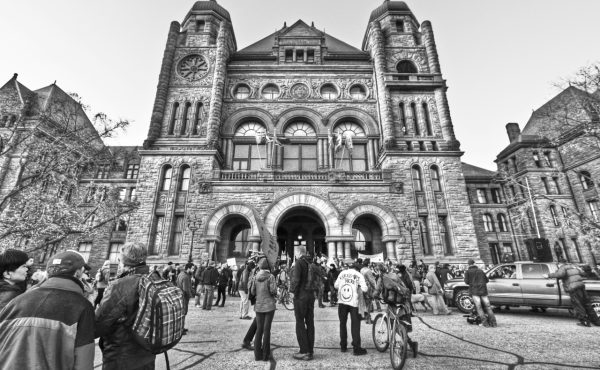

Photo of Mississauga City Hall by Benny Lin.

17 comments

“the corporation is valued at approximately $250-300 million (though it also has a debt of $289 million, which could impact its sale price)”

Someone who did not read TFA might think that Enersource has a net value of essentially zero. From TFA:

“Enersource brings in about $700 million in revenues a year, has about $630 million in assets and is about $289 million in debt.”

So net assets after debt is about 340 million. Their 90% share of that is 306 million on which they are receiving 8 million, or 2.6% return. You could get better in a bank account on a purely financial basis.

Unlike the wholly owned Toronto Hydro, their 10% minority shareholder can object to arbitrary demands for dividends. As for the hydro poles, the City could take them into public ownership from Enersource – after all, the City of Toronto used to own lighting poles before outsourcing them to Toronto Hydro.

Such short-sightedness. Hard to believe that they didn’t see this coming, or perhaps were just blinded by political and financial gain. It was easy to stay on top of the finances when tapping virgin development land and receiving a pile of development fees. But it’s not sustainable and they must have known it.

I grew up in Mississauga and remember reading many urban planning studies that showed innovative ideas for medium to high density development which seem to have had no impact. Again, blinded by short-term gain. To me, this is a prime example of lack of political will, not lack of knowledge, being the main problem.

The important distinction between Toronto and Mississauga in this case is that Toronto is contemplating selling of its hydro resource to pay down a percentage of its debt, while Mississauga is doing so to avoid *going into* debt.

I would also add that what Mississauga failed to plan for is the degree to which the province would permit Peel Region to tax Mississauga residents in order to subsidize Brampton and Caledon residents.

Wow, looks like Hazel should have left years ago. Who couldn’t have seen this coming? Now this famous mayor’s legacy is going to be one of financial undoing.

Diane: does it really matter whether Toronto paid for its infrastructure when it bought it or afterwards? In end, Mississauga, and Toronto if it sells its assets too, will be back at square one the next time a big spend is needed.

“does it really matter whether Toronto paid for its infrastructure when it bought it or afterwards?”

Um – I guess if you think interest payments matter, then yeah.

I think the question of Mississauga becoming a unitary authority is important though – I would suggest that rather than having a City of Toronto Act there should be a Cities of Ontario Act, which begins to kick in when StatsCan declares that a city has reached a threshold population. Brampton and Caledon mightn’t like that, since they are getting a form of equalisation from Mississauga in terms of how Peel is funded, but less populated municipalities in the rest of Ontario without more populous neighbours seem to manage.

Ah, the old Peel separation thing. Mississauga didn’t complain until it approached built-out status when the money from all three municipalities were pooled, and Mississauga came out ahead, with Caledon and Brampton subsidizing Mississauga since it was growing the fastest.

Now that Brampton’s now growing the fastest, and is getting the subisidies through the pooled infrastructure spending, Mississauga decided that now that its turn at the trough was done, it was time to high-tail it out of Peel. Not as straight forward as Mississauga-boosters like to make it out to be.

Mark Downling: Interest payments matter but Toronto is still getting a pretty sweet return on its investment from Hydro. If it sells off now, what are we going to sell the next time we need new subways, new bridges, new whatever? None of this selling off is good in the long-term. But as you point out, Mississauga is getting a pathetic return on its investment so maybe they’re a little better off than Toronto if they sell.

The way I read it, these potential one-time sell-offs of public assets aren’t only problematic “the next time we need … new whatever,” they’re serious proposals to kill golden geese (however small the eggs they lay may be).

I did some contract work at Enersource. The employees salaries were to die for.

Guess that is going to change when it changes to public hands.

If they actually do put the cash into an account and don’t touch it, the annual interest will be higher than what they’re getting right now. Considering the fact that it was worth $800M at the time it was deregulated, this is probably a better time then ever. Add on the fact that after Dec. 31 they’ll have to pay tax on the transaction and their buy-out clause with the 10% holder expires and it only makes sense for a sale to go through this year.

looks as if the star story was a bit off the mark.

“No decisions have been made and all information gathered will be brought back to Council for

consideration. It is important for Council to have an assessment of the market value of Enersource in

order for Council to consider all options.”

McCallion noted the City has until Oct. 31 to take action on a contract clause that could force either

partner to buy the other out.

“The time is coming close to making a decision. And, getting a valuation from RBC Dominion Securities,

which we got yesterday, was the first step”, she said.

Also to be considered, if they sell to private interests there is a huge transfer tax that would be payable. If they sell to another municipally controlled utility, the transfer tax is waived.

Even if it was a fiscal paradise, who cares? It is still pure hell when it comes to quality of life. Drive-drive-drive everywhere, tons of concrete and zero personality. I hope they get hit hard and their short-sightedness really bites them in the ass. Maybe they’ll finally get rid of their moronic mayor and try to make their city liveable as well as financially viable.

Hey there. Interesting debate about Mississauga here. I’ve been researching Mississauga Council since June 2006 and believe me, there’s a huge difference between what the public sees or reads at mississauga.ca and the reality (as gleaned via Freedom of Information)

Some of you might be interested in actual video of Wednesday’s “Enersource –we’re inviting bidders” announcement. What’s really interesting is that Hazel McCallion was still out of the country when Council went in-camera (behind closed doors) to discuss Enersource.

http://video.google.com/videoplay?docid=5186249821488326860

Justin’s comment, “I did some contract work at Enersource. The employees salaries were to die for.” So are many of the employee salaries in the City itself. And of course, the salaries of Councillors is the stuff of legend.

That’s why I’m forced to wonder how much of this “desperation” surrounding Enersource is “infrastructure” or that a whole pile of employee contract negotiations are going on for 2008.

Either way, it’s impossible for citizens to follow any money trail. They have such a tourniquet on Freedom of Information that it would take several years with a good portion of the stuff you get back with black lines through it.

It’s amusing just how many Mississaugans haven’t a clue about The Real Mississauga. I was such-a-one for decades.

Signed,

The Mississauga Muse

@ chephy: No kidding. Just wait until gas hits $2.00 per litre.

Mississauga, like all established cities face big financial problems once there growth plateaus. Cities need help from the provincial and federal governments.

http://naturopathicessentials.blogspot.com/

Mississauga should separate from peel so we pay less taxes stupid Brampton people

I think Mississauga is a haven. The beauty of this place amuse me.