Premier Dalton McGuinty thinks Toronto City Council should freeze taxes as “symbolism†of government taking action in tough economic times.

Isn’t that cute?

This is a premier whose government has racked up multi-billion dollar surpluses while our city, in the middle of an economic boom, was struggling to make ends meet. This is a premier who has benefited from downloading on municipalities to the tune of $3 billion per year. This is also a premier who recently sent out his finance minister to lay the groundwork for his government to go into deficit — a financial position that is illegal for cities to be in — instead of cutting services, like he is implicitly demanding of Toronto.

So, Mr. Premier, I’d kindly ask you to take your nose out of our city’s budget process. If you want to influence it and ensure that our taxes are frozen, you’ll upload the download like you’ve promised repeatedly over the past decade. And until you’re ready to do that, how about you get to work on saving the thousands of manufacturing jobs lost across this province?

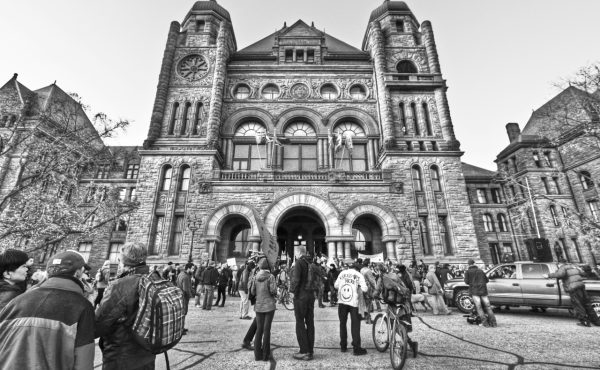

Photograph by vtgard.

15 comments

In the category of things I want to read about when spacing shows up in my reader: not this.

Apart from simply advocating the ostrich position, Mike, perhaps some context to your statement might help us understand what you’re trying to say.

“perhaps some context to your statement might help us understand what you’re trying to say.”

I’ll take a swing:

The Mayor can issue his own press releases?

That’s better. Though I don’t think the releases usually say “Cute.” They should maybe.

Mark, I wish the mayor would tell the Premier to flick off when he pulls stunts like this. For better and worse, it’s never been his style to do that. So I think it’s far past time other people in this city start sending that message themselves.

And for whatever it’s worth, if Stintz’s comments in today’s Globe hold up, it looks like having a property tax increase this year won’t be a partisan issue. The contested question will be by how much do they go up.

Gah – property taxes are collected in the strangest way possible, creating the same “property taxes going up” headline every year. In fact, it is very likely that property taxes, as a percentage of home value (which is how they are collected), will actually go down this year, despite this termed ‘increase’.

No one complains that income taxes go up each year as our overall income as a society rises. Yet, the provincial government automatically shifts down the property tax rate (as a percentage) as property values rise. Therefore, despite what is termed a tax increase, if your home value stayed the same, you’ll be paying less tax next year. You would only end up paying more if your home value went up. Terming this a tax increase is analogous to the following: “my income went from 40K to 45K this year, increasing my provincial tax bill. Therefore, we’ve had a tax increase.” Completely nonsensical.

(Although, the entire preceeding argument is based on an increase in housing prices year over year, which will likely remain true for this year, but is questionable for next.)

Maybe Toronto is struggling to make ends meet because it does not charge its residents enough! Here is a clue, stop spending $8,400 per household while collecting only $2,200 in property tax then crying poor.

Perhaps if city council had the guts to increase taxes as much as spending one would feel sorry for Toronto. The rest of the GTA has a more legitimate complaint to the Province. In Mississauga/Peel for example, households pay on average more than $500 per year in property tax than the average household in Toronto and gets $ 4,573.71 less in services.

The Province also gives far more to Toronto than other city. Over $2,200 per household (http://www3.thestar.com/static/PDF/070918_905_stats.pdf). The city spends, the province pays, reserve funds and businesses get raped. We get left with a city council that amounts to the left insisting someone else pays and the right insisting no one pays. And we wonder why Toronto is dysfunctional.

Regarding the McGuinty government:

Is it true that the Ontario Legislature has voted to take the day off for the federal election? Tell me it isn’t so!

George – it’s so.

Glen – if Peel et al would take our 100 year old sewer pipes, our homeless and our social housing need off our hands and start increasing the modal share of transit to anything near Toronto levels I imagine the gap would narrow a touch. By the way it’s just civic economics – analogising it with rape is idiotic.

An act of idiocy from a guy who isn’t even up for election. I’m befuddled. What happened to the intelligent McGuinty?

Glen is right about businesses getting ripped off but he continually misses the point that Toronto taxpayers have paid down the debt on its infrastructure (mostly) and Peel, Durham, Miserysausage etc haven’t. Or the fact that a large majority of Toronto properties are half the size of the outer ‘burb regions, thus they have less demand on the infrastructure.

This is not a right-left arugment: its much more about fairness and responsibility. The Ont government continues to fail Toronto and surrounding municipalities. All those residents vote for the all the parties, so this really shouldn’t be argued as a “Miller is a socialist” (as the Toronto Star comments section seems seems to be consumed by).

To follow up on what MarkG said (and what I said in a post on Spacing Toronto in the spring), the Premier ought to know that a “tax freeze” for a city is completely different from a “tax freeze” for the province. If the province “freezes” income tax rates, its revenues still go up considerably due to growth and inflation. If the city “freezes” its property taxes it gets *exactly the same dollar amount* as the year before — which means, effectively, a cut in revenues due to inflation, or what is really a tax cut.

It’s another illustration of why the property tax system needs to be revamped.

city staff insider,

Mississauga has no debt. While in Toronto the interest paid to service the city’s debt is the second most expensive item in the operating budget.

As far as the less demand for infrastructure therefore less property tax argument. I call bull. Have a look at the budget, look at the major expenses and tell me what scales so well with density, or lot size. To provide police, ambulance, fire, social, shelter, parks, TTC, solid waste management, transportation infrastructure, library, children’s services, public health, homes for the aged, etc.,amounts to over $5,400 per household. These do not scale with density.

While there are some savings to be had by Toronto’s density they are at most 10%. Even with any savings the city still spends far more than other GTA cities per household and collects less from them.

In Toronto, the property tax on an average home represents only 26% of the actual cost of services.

In Mississauga, property tax on an average home represents 73% of per household cost of services.

The shortfall lands on the non residential sector which is why they are leaving the city.

Mark,

You have it backwards. Unless you are saying that Toronto’s 100 year old sewer pipes, homeless shelters and social housing, and Public Transit expenses are the reason that residents in Toronto pay [b]less[/b] than those in Peel.

Now I understand how councillors get elected in Toronto. Just promise to spend more and tax less. It seems to reconcile with voters.

PS. run to the dictionary.

Do I hear crickets?