Toronto’s streets are in terrible shape. I notice this as a pedestrian, trying to cross at intersections where the zebra stripes that define my safe(r) space to cross have mostly disappeared and have never been repainted. I notice it as a cyclist, bumping across and dodging sections of crumbling asphalt in bike lanes. I notice is as a transit rider, shaking and jolting as the bus I’m riding traverses potholes rough enough to shake up even a huge transit vehicle.

And I notice it as a driver. Before I started driving again a few years ago, I kind of thought that the crumbling pavements that jolted me as a cyclist would be muted by the sophisticated shock absorbers of a car. But I drive a little car, and I feel every bump and hole shaking me as I negotiate Toronto’s roads. In the driver’s seat, I see a constant reel play out in front of me of the potholes puncturing our roadways.

Massive potholes on Highview Ave at S Edgely Ave and Highview Ave at Pinegrove Ave. @311Toronto can these please be patched soon? pic.twitter.com/YOhph9wsyf

— Kevin Rupasinghe (@KevinRupasinghe) February 17, 2023

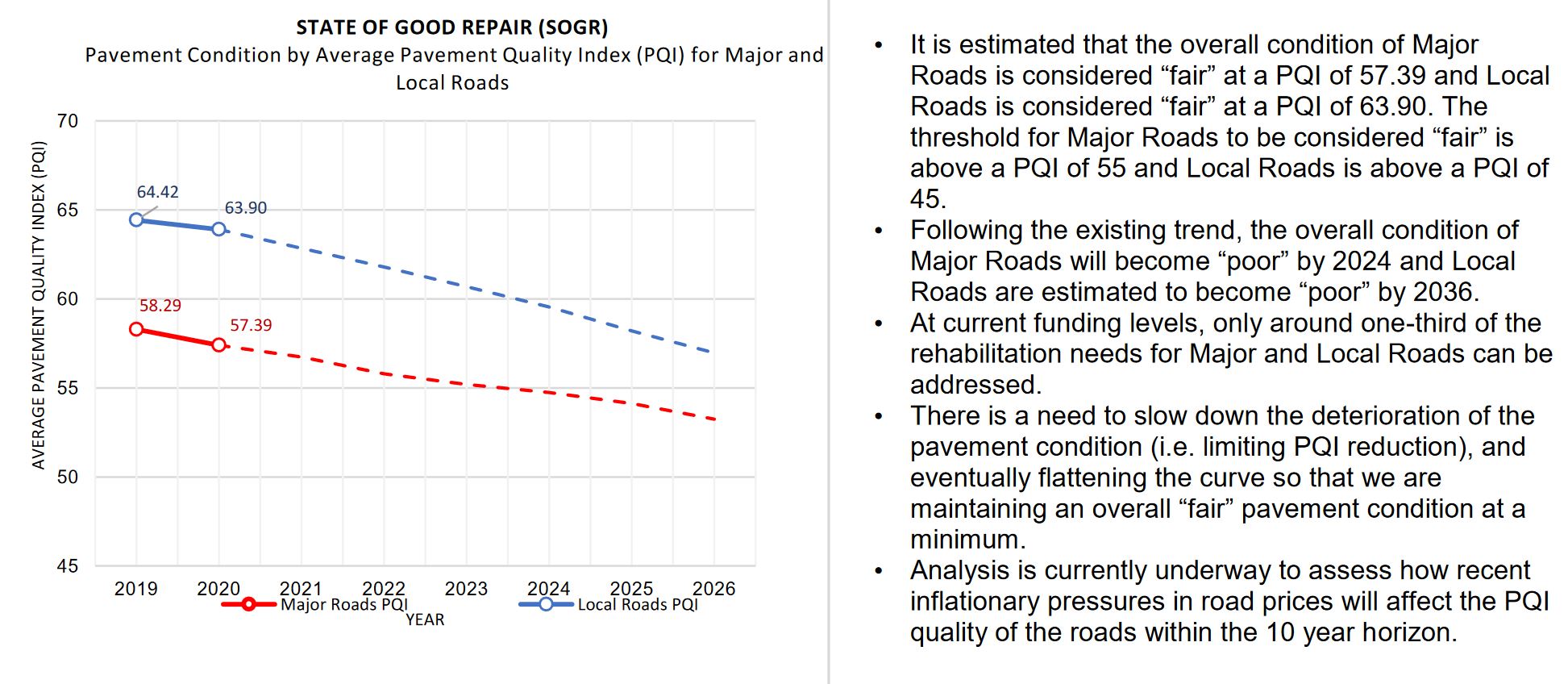

And it’s only going to get worse. Toronto’s latest budget specifically under-funds road maintenance needs, with the result that major roads will on average be in “poor” condition by 2024, with local roads following behind a few years later.

The solution is to spend more money on maintenance. But this maintenance is being neglected specifically because Toronto is in a perpetual budget crunch. If we want better roads, where do we get the money?

There’s an obvious solution, already tried. Drivers suffer the most from bad roads – not simply in discomfort, but also potentially from expensive damage to their cars. So it makes sense that drivers specifically could contribute to better maintaining the roads they rely on.

And Toronto has the means to make that happen. The City is allowed to charge a personal vehicle registration tax – a payment drivers make when they regularly renew their vehicle registration. Toronto in fact implemented that tax under Mayor David Miller, adding $60 to the cost of registering vehicles for Toronto residents, raising around $60 million a year. But Rob Ford abolished it as soon as he became mayor.

As we launch into a new, unexpected mayoral election on the heels of a budget that has revealed just how bad Toronto’s roads are expected to get, it might be time to bring this idea up again and debate it.

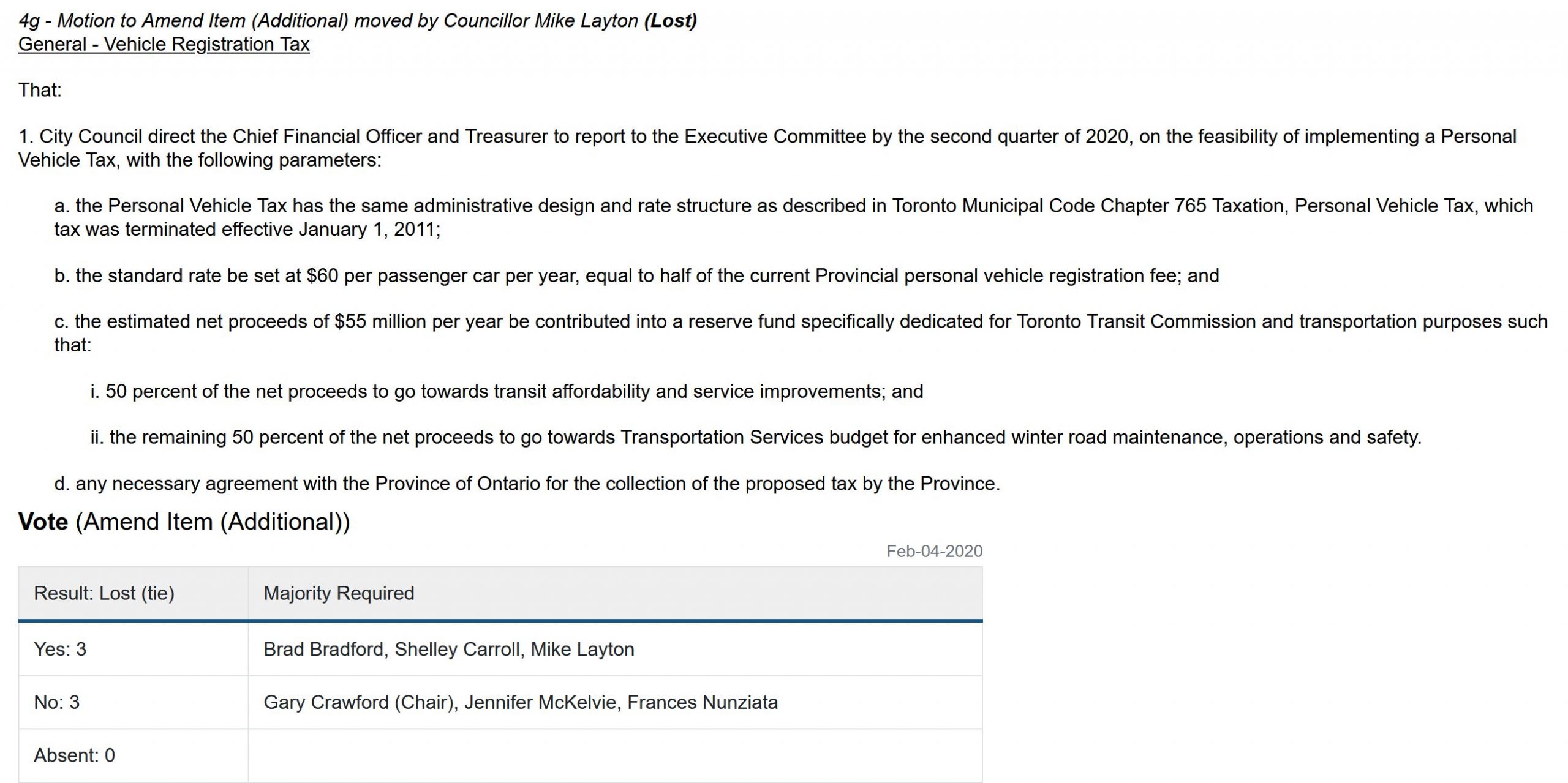

When Mike Layton was a councillor, he regularly introduced motions at budget time to reintroduce the tax, and they were regularly voted down (although in 2020 it almost got accepted by the budget committee, losing in a 3-3 tie (item 4g), with potential new mayoral candidate Brad Bradford among those voting in favour).

Progressive councillors proposed it again in 2021, to no avail. With Layton gone and a new slate of councillors this year, however, no-one took on Layton’s mantle as a vehicle registration tax champion in this year’s budget deliberations (they may have hoped that a more general review of revenue tools that was approved might include it, but no-one moved a motion to explicitly do so).

Layton always called for the proceeds to be split between road maintenance and the TTC. It was a worthy concept, but dividing the spoils meant the proposal had even less appeal to drivers and the councillors who prioritize driver interests.

If we instead devoted the entire sum to road maintenance, it would still help non-drivers as well as drivers. As a frequent walker, one thing I would want the funds to focus on is maintaining striping on roadways and crosswalks. Zebra stripes were introduced to Toronto crosswalks because testing revealed they reduced pedestrian-vehicle conflicts by making pedestrian spaces more visible. Yet they have been allowed to wear off at intersections across the city. Lane striping for cars has also been allowed to fade across the city, creating uncertainty and danger for drivers. Paint isn’t that expensive – a few million dollars extra a year should help ensure fresh, clear striping that makes the roads safer for everyone.

Cyclists would obviously benefit from better road surfaces. I live in the east end and take the Shuter bike lanes when going downtown – they are like a secret passage from the east to the heart of the city. But until recently, they were in terrible shape, making them a bone-jarring route that many cyclists avoided. But most of Shuter was re-paved not long ago, and the difference is remarkable – the repaved sections are now a joy to ride.

As for transit, people who ride buses – the workhorses of our transit system – would be grateful for smoother rides, and perhaps a few more riders would choose to take the bus. Bus drivers would particularly benefit, since they can suffer stress injuries from the vibrations generated by excessively jarring routes. The buses themselves suffer, too, and better roads would likely save the TTC some maintenance costs.

But car drivers would be the biggest beneficiaries, which is why it makes sense to have them contribute specifically to the road maintenance budget. It’s worth noting that, even with their contribution, the vast majority of the road maintenance budget would continue to be paid for by all Torontonians, including non-drivers, through property taxes.

One argument for leaving roads in poor shape is that it discourages speeding. However, the records from the recently installed speed cameras show that there is still plenty of speeding, and rough roads increase the danger of loss of control and accidents resulting from that speeding. Instead, what we should be doing is reconceiving roadways when we resurface or rebuild them, so that they structurally discourage speeding – something we can accomplish more quickly if we have the funds to catch up on maintenance.

Other safety measures can be incorporated in road rebuilding too, such as bulb-outs that both reduce pedestrian crossing times and “daylight” intersections by preventing drivers from parking illegally where they block views for other drivers entering the intersection (Ottawa has a lot of these, for example).

A significant obstacle to a renewed personal vehicle registration tax would be Premier Doug Ford. Not only was cancelling the vehicle registration tax one of the first actions he and his brother took when his brother became mayor and he became a councillor, but Premier Ford recently cancelled the provincial registration fee for personal vehicles. Toronto re-introducing the tax would probably make him apoplectic, which might be part of the appeal for some but puts the proposal in peril. It’s entirely conceivable that Premier Ford would in response introduce an amendment to remove this tax from the City’s powers.

The province’s rescinding of its own vehicle registration fee also adds practical complications, since the City can no longer simply piggy-back on it. However, the actual process is not much changed – car owners still have to renew their registration, and there is still a fee-paying structure for heavy vehicles. It does not seem that challenging technically – the issue might be more the province refusing to co-operate.

One interesting option being proposed in California is to charge different amounts depending on vehicle weight, reflecting the greater wear-and-tear heavier vehicles cause. This could help discourage the trend towards drivers buying oversized trucks and SUVs that might not be necessary in an urban environment and that are more dangerous in collisions. The Province already charges weight-based fees for large vehicles, so the concept is not a stretch. But this concept might be easier to implement at a provincial level, should a government more open to the idea get elected. For the City to re-introduce the tax independently, it would be simpler and perhaps more political feasible to charge a flat rate.

Given the terrible and declining state of Toronto’s roads, a vehicle registration tax that was entirely devoted to improving road maintenance might be supported by many drivers, and by the councillors who listen to them, where they would have not been supportive in the past when the roads weren’t quite as bad and the funds would be split with other services.

In one of his last acts, former mayor Tory got council to agree to ask staff to investigate various revenue tool options that the City could use. The focus was on a commercial parking levy, but the mandate is open-ended. Given the need for more funding to maintain the city’s roads, staff should definitely delve into the details about how a vehicle registration tax could work – and politicians, led by whoever becomes our new mayor, should be willing to consider the idea.

While it might be safer to wait until a friendlier provincial government is in place, there’s no guarantee that will be the case for many years. But we can guarantee that Toronto’s roads will continue to get worse if we don’t find more money for their maintenance. It might be time to do something about that.

3 comments

Toronto’s largest companies have the addresses of their employees for paycheck purchases. Those employees who live outside the Toronto boundaries would pay a small infrastructure toll, administered by the company’s HR, and that revenue could be applied to the roads. Road tolls are very expensive to administer on the back end, so having the employers administer the entire thing as a municipal tax should work. All that was needed was the employees address. You come from another municipality, use and destroy Toronto infrastructure, there should be a toll.

The City of Toronto needs to change its policy ratings. Currently, the single-occupant automobile gets #1 priority.

Should be…

#1 priority—emergency vehicles

#2 priority—pedestrians

#3 priority—public transit

#4 priority—cycling

#5 priority—delivery & contractor trucks

#6 priority—autos with more than one person

#7 priority—single-occupant autos

#8 priority—personal trucks or SUVs

Vehicle registration tax is a good idea. Those who use our roads should pay a nominal fee to increase maintenance.