Dense /dens/ (adjective)

1 marked by compactness or crowding together of parts

2 slow to understand: thickheaded

Affordability is so damn complex. In my experience, those who say otherwise are either selling something, blinded by their academic niche, simply ignorant or some mix of these. Perhaps not surprisingly, these seem to be the same folks who are the most vocal about the issue. So, it is best to steer clear of the topic unless one is ready for a confusing battle of wills and words. I shied away from the issue in Dense Confusion (Part 1) for this reason, but against my better judgment, I should address a tiny sliver of the issue based on all the questions I received after publishing the original piece. To avoid any misgivings, however, I intend to remain focused on the relationship between “higher density” building types and affordability, highlighting some research on the often overlooked implications of level changes on costs. We will then use this to glean some insights about why so many well-meaning initiatives, like the government’s recent TOD experiment, often fail.

As usual, some important caveats and context. To reemphasize, this is not a comprehensive piece on affordability. I have several pieces that I’ve written over the years that address certain facets of the issue in more detail, but even these taken as a whole are not exhaustive. There are simply too many variables in the contemporary world that influence housing costs. Regardless, I will link to some of those pieces throughout this article as necessary, with a longer list provided at the end. I will also I will rely on related S101S pieces, to fill in any necessary gaps in information that I could not include here to keep the article at a reasonable length. They will be linked throughout and at the end of the piece for folks interested to get a more in-depth understanding.

First, some basics: it’s essential to consider that “affordability” as a concept is subjective and varies based on individual circumstances. What might be affordable for one demographic or income group may not be feasible for another. Low-income and marginalized households, in particular, face significant challenges in accessing adequate housing due to limited resources and societal biases. This, in turn, can exacerbate our current “affordable housing crisis”. Similarly, defining ‘affordable’ can vary from one place to another and looking closely into the effects of these decisions is instructive in showing how political manoeuvres can influence societal perception. Locally, Chris Cheung’s “What Does ‘Affordable’ Housing Even Mean Anymore?” piece does a great job of describing the implications of the latter, while the Building Affordability episode in the Urbanism Vancouver podcast speaks well to the issue within the local context.

The above also points to the relativity of the concept of “crisis”. For example, initial studies by Andy Yan, Director of the City Program at Simon Fraser University, point to the fact that within the Vancouver context, the term ‘housing crisis” was used as early as the 1940s. Governments have only intervened at certain points since then, so important questions lie in addressing who is in crisis, at what time, and what made intervention necessary. This will unearth some ugly societal biases and prejudices. Ricardo Tranjan’s ‘There Is No Housing Crisis’ is worth a careful read on this topic and it’s worth noting that two-thirds of Canadians own their homes and are building equity.

Regarding the built environment, different building types—from single-family homes to residential towers—play pivotal roles in shaping the affordability landscape. But, it’s important to note that affordability isn’t only determined by the physical structure: it’s influenced by a wide range of factors, including but not limited to, construction costs, regulations, market dynamics, socioeconomic conditions, location…and of course, the cost of land, which is arguably the biggest influence.

Affordability isn’t solely about the initial cost of housing either. Operational expenses such as utility bills, maintenance, and transportation also significantly impact affordability. For example, energy-efficient features that lower monthly utility bills contribute to long-term affordability by reducing ongoing expenses for occupants. Homeowner dues alone can also match actual rent prices in more affordable jurisdictions.

What should be clear then is that any attempt to meaningfully address the issue must deal with multiple variables simultaneously. Too frequently, folks tout “supply” as the ultimate saviour. Full stop. Failing to think about a flurry of questions including but not limited to: who the supply is for? Where? Are there biases inherent to these selections? Who is not included in the target demographics? Why? How were the target demographics chosen? Who are the beneficiaries of the increased supply beyond those targeted? What regulations are affecting this? Municipal? Provincial? National? What elements can be controlled by decision-makers? How are market dynamics going to respond? Are there checks and balances in place if they do not respond as expected? What building types are being chosen for the target demographics? What are the construction costs associated with the building types selected? Do the operational costs of these types match the budgets of target demographics? Is the supply “secure”, in perpetuity? Who controls ownership?

This is just a tiny sample of questions that often go unanswered but intense “supply” advocates. Is supply an issue? Sure. Sometimes. But it’s only one of the many puzzle pieces necessary to address the issue in the contemporary world and sometimes—gasp—it’s not the most important. Other barriers can be more critical.

The Provincial government’s most recent attempt to address the issue focuses on regulation around transit nodes: zoning for more height (adding more supply through increasing the number of units) and eliminating parking (made possible by proximity to transit to reduce unit costs by getting rid of the large price tag of underground parking, currently standing at $65,000-$75,000/stall).

As made clear in the Dense Confusion (Part 1), good intentions lie behind the government’s actions: tackling something they have control over (regulations) towards reducing construction costs (parking stalls) while increasing the supply of housing (“denser” building types). As also highlighted, however, the methods they used had a lot of errored assumptions on other important, related variables. For example, its broad brush approach dismissed the relevance of location and the market dynamics and socio-economic conditions related to this. Ditto for the socio-economic impacts of the proposed conditions as well as confusion about the definition of ‘dense’ housing. Operational costs were not even mentioned, neither were important issues regarding the skilled trades necessary to build such projects. What will happen, for example, in areas where skilled trades required for the build-out of the initiative are already limited as people retire in the coming decades?

One can read the piece to get more of the details, what I would like to focus on here are two variables connected directly to the building types selected and their connection to unit affordability—construction costs and market dynamics related to height—each of which can offset any gains made by the regulatory changes proposed.

First, construction costs. It is well known that construction costs are connected to residential building types. This can be broadly divided into concrete and wood-framed construction. Cast-in-place concrete construction dominates mid-rise and high-rise construction costs, while wood-framed construction is used mainly for low-rise building types. Using the Altus Group’s 2023 Construction Cost Guide as a good baseline, wood construction is inherently cheaper cost than concrete construction. Nothing new here. For example, in Vancouver, the cost per square foot runs at about $310/sq.ft. at the low end for an apartment of up to 12-storeys while it sits at $180/sq.ft. for a low-end “row townhouse”. A low-end “13-39 storey” condominium costs about $330/sq.ft. With 6-story wood-framed apartments sitting at about $245/sq.ft.

With construction costs as the sole metric, the government’s decision to bias concrete construction building types within their transit node radii is questionable from the affordability perspective. A more interesting question would be: what is the maximum density we can achieve using the wood-framed construction while eliminating parking requirements? More so, when construction time is accounted for, since wood-framing can also be significantly faster than concrete construction.

More broadly, this brings up questions about the possibility of using housing policy to grow the mass timber industry so that it is more competitive with concrete. Why not use this moment to initiate and grow innovative industries—such as the off-site prefabrication industry—that may be important if there is a lack of trades as noted above?

Returning to current construction costs, an informed cynic who recognizes that context matters and that density and unit numbers depend on the land area would rightly respond:

Okay….hold up, hold up….assuming a small urban lot, the number of units in a “13-39 storey” condo is quite a bit higher than that in a 6-story wood-framed apartment. A difference of about $100/sq.ft. in construction cost is well worth the increase in unit supply created by the different building type.

A point well made. But there is more to this than meets the eye. Both arguments are only valid within their little rabbit holes—one focused only on construction costs, the other on unit numbers. This points to the error in focusing on a single variable at the expense of others and transitions us well into another important overlooked variable that should taken into account—market dynamics related to the height of each floor. The underlying question is seemingly straightforward: how does the height of a unit affect its cost?

Everybody intuitively knows that the answer to this is yes. Views and changes in height are currently monetized, so there is a marked difference in cost between a unit on the second floor with a street view and one 20 stories with a beautiful view. But by how much?

I tried to gather this information locally over a decade ago—asking everybody from the Real Estate Foundation of BC to individual realtors—and ultimately failed. The closest I got was a very crude estimate: that identical units would rise in cost by anywhere between $10,000-$20,000 per level increase, up until the sub-penthouse and penthouse where all bets were off. Thus, one could expect a cost difference of anywhere between $100,000-$200,000 for identical units 10 storeys apart. Not insignificant, given that

More recently, Andy Yan attempted the same and encountered even more complexity—issues such as location, also affect the cost of unit costs by level. Units in a high-rise overlooking Coal Harbour, are much different than a residential tower on Scott Road in Surrey, for example.

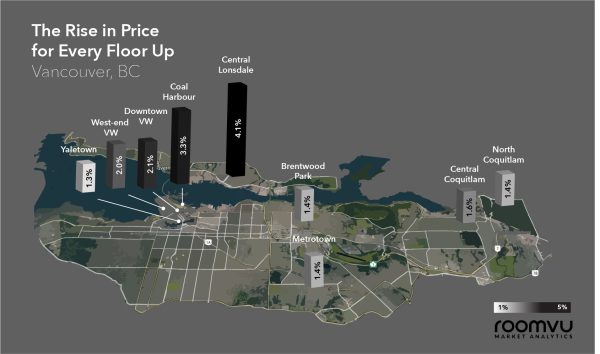

In late 2019, the Roomvu Blog came out with the first such study that I’ve seen—and have since read. Although it’s not perfect and comprehensive across all building types, it did analyze 20,000 MLS residential high-rise entries over three years and gleaned some important insights worth reflecting on:

- The higher the floor, the more expensive the price tag but context matters – That is, prices depend on neighbourhoods. For example, the levels in Coal Harbour cost more than equivalent apartments in Central Coquitlam.

- The price per square foot per floor-level is greater in neighborhoods with better views of the city or the water – Central Lonsdale, for example, costs more per floor-level than Metrotown or North Coquitlam.

- Price increase per level changed within the same building – Building costs were divided into distinct “zones” with each building with costs varying accordingly. Within the City of Vancouver, Zone 1 (levels 1-10) increased approx. 3% cost increase per floor. Zone 2 (Floors 10-25) increased approx. 0.7% per level and Zone 3 (Floors 25-35) increased at about 1.2% ber level, while Zone 4 (Floor 35 and higher) saw an increase in 2.3% per floor level.

Simply put: location matters, as does unit distribution in the building—over and above the construction costs and unit numbers mentioned earlier. These findings support both my early research and Yan’s preliminary findings. It also, at least partially, explains why our region’s tower-building boom within the past three decades has been followed by increasing unaffordability.

Applying these findings to the recent government legislations, one can see that the costs associated with eliminating parking stalls can be easily negated by the increased costs related to level changes, depending on building type. Moreover, it puts yet another large question mark on the tower building type pushed by the regulations. Based on standard market conditions, even if ‘affordability’ was clearly defined by the legislation—which it isn’t—one would be hard-pressed to get more than a small handful of units across of limited number of low-level floors to meet such targets. The rest would quickly be out of reach. That local residential high-rises typically have a small footprint, makes the potential number even smaller.

The interaction between construction costs, unit cost and market dynamics also explains why derivatives of row houses and garden apartments have historically been—and continue to be—the least expensive building types for families of moderate means in North America. These are two of the most popular housing types in the history of settlements globally.

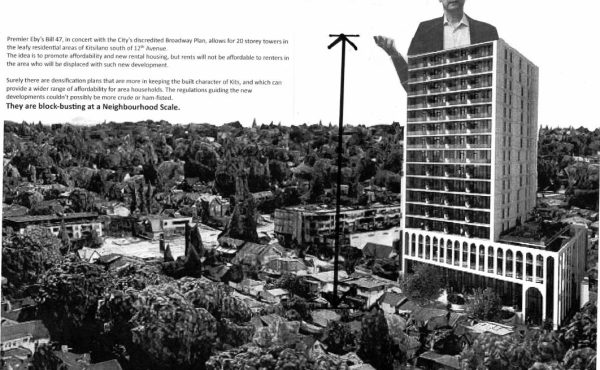

This also questions the government’s naive broad-brush approach that assumes the same conditions across the region. Context matters. Unit costs are directly related to the neighbourhood, including the degree of cost increase by level. Location, location, location, has been a common saying for decades—. Why would be any different now? Ultimately, the effect of most of the most recent regulations—from the Broadway Plan to the most recent Transit-Oriented Development legislation—is to prohibit all but the most expensive forms of housing development, ironically in the name of affordability.

Barring outside intervention and subsidies from governments or other organizations, towers are preserves for the wealthy in the modern free-market world. Bill 47 endorses the idea that those who develop first will take all the profit, leaving those with non-tower sites behind. The same critiques that hold suburbs as racially and economically restricted areas are equally applicable to high-rise building types, with laws supporting them acting as deadly instruments to keep out moderate‐ and low-income families and households. Instead, “democratizing the market” by providing the same up-zoning opportunities to all owners, should be encouraged.

Given their increasing frequency of zoning changes in unwavering support of high-rise developments to the exclusion of other building types, it is becoming more difficult to believe that planners and public officials who draft and enact such regulations do so without recognizing that the majority of the population will be excluded from such developments and neighbourhoods. Is it possible that there is an institutionalized bias towards higher forms because penthouses can be assessed at greater values for tax collection? Who knows. But it certainly would not surprise, if there was. Speculators will happily run away with the profits, leaving those purchasing or renting to pay the municipal taxes and other costs. This is exclusionary zoning at its finest.

In light of the above, an alternative strategy to Bill 47 could have included the following:

- Approaching intensification as context-specific with a more open, varied approach to deploying density – This would include but not be limited to sites immediately adjacent to transit nodes. Unit per acre yields need to be considered across large swaths of the urban fabric to truly understand and compare towers on assembled sites versus other forms on un-assembled sites. Towers require setbacks requiring greater land area to develop, often rendering adjacent properties undevelopable.

- Focusing on forms that do not require land assembly – Allowing lay owners can participate in redevelopment with their land assets while remaining on-site and in their respective neighbourhoods. Towers will drive longstanding owners out.

- Streamlining the approval system so that financial rewards are contained to those that design and construct – A well-warranted approach worth considering that would eliminate the non-value participation from those that contribute to speculation.

- Ensure that savings from eliminating parking lead directly to savings for purchasers and renters – This can be done through exploring different agreements—like those for mini-housing.

Here again, we see vast confusion by government officials about the complex relationship between building types and affordability, as well as the fact that truly addressing affordability necessitates a multifaceted approach involving input from diverse people and organizations—from policymakers and urban planners to developers and community members. From economists to architects, builders to manufacturers of building products. Closed-door discussions among a handful of people have only led to oversimplifications and the ineffective policies we have seen from government thinking over the past decades. One cannot help but wonder if and when local citizens will start seeing through the shenanigans and demand better.

***

Related pieces:

- Dense Confusion (Part 1)

- Altus Group – 2023 Construction Cost Guide

- What Does Affordable Housing Even Mean Anymore?

- Building Affordability – Urbanism Vancouver podcast

- There is no Housing Crisis

- The Rise in Price per Floor-Level | Vancouver Real Estate

- S101S: Describing Building Types: Why They Matter

- S101S: Understanding Residential Density: Why is it so Confusing?

- S101S: Explaining Transit-Oriented Development: Benefits and Drawbacks

- The Tower Default – Part 1

- The Tower Default – Part 2

- S101S – Formal building types

- S101S – Describing Building types

- Understanding Affordability: A Partial Picture

- Understanding Affordability: A Partial Picture – Bertaud’s Response

- Observations on Bill 47 by Scot Hein

- BC Bill 47 – Transit-Oriented Zoning Map

**

Erick Villagomez is the Editor-in-Chief at Spacing Vancouver and teaches within the UBC’s School of Community and Regional and KPU’s Wilson School of Design.